Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Company has a total indirect cost of Php3,000,000 which are allocated based on the traditional costing system using the number of units produced

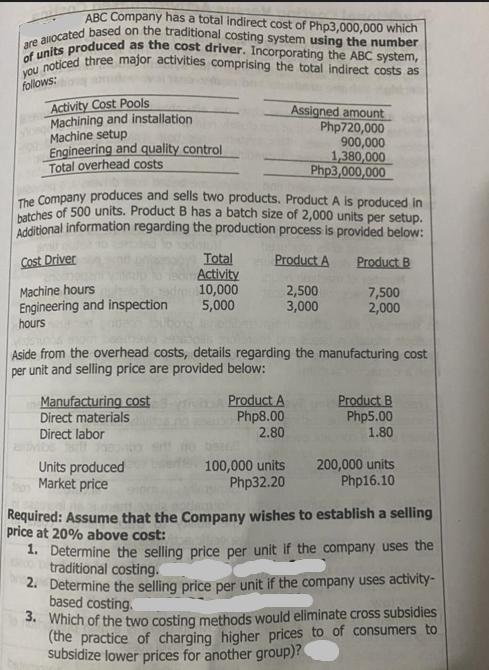

ABC Company has a total indirect cost of Php3,000,000 which are allocated based on the traditional costing system using the number of units produced as the cost driver. Incorporating the ABC system, you noticed three major activities comprising the total indirect costs as follows: Activity Cost Pools Machining and installation Machine setup Engineering and quality control Total overhead costs The Company produces and sells two products. Product A is produced in batches of 500 units. Product B has a batch size of 2,000 units Additional information regarding the production process is provided below: per setup. Cost Driver Product A Product B Machine hours Engineering and inspection hours Manufacturing cost Direct materials Direct labor Total Activity 10,000 5,000 Units produced Market price Assigned amount Php720,000 900,000 1,380,000 Php3,000,000 Aside from the overhead costs, details regarding the manufacturing cost per unit and selling price are provided below: Product A Php8.00 2.80 100,000 units Php32.20 2,500 3,000 7,500 2,000 Product B Php5.00 1.80 200,000 units Php16.10 Required: Assume that the Company wishes to establish a selling price at 20% above cost: 1. Determine the selling price per unit if the company uses the traditional costing. 2. Determine the selling price per unit if the company uses activity- based costing. 3. Which of the two costing methods would eliminate cross subsidies (the practice of charging higher prices to of consumers to subsidize lower prices for another group)?

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Sure lets work through each of the required steps 1 Determine the selling price per unit using the traditional costing First calculate the total cost per unit for each product using the traditional co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started