Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Company has an Apr 30th year-end. Note that prepaid expenses are initially recorded in asset accounts, and that fees collected in advance of work

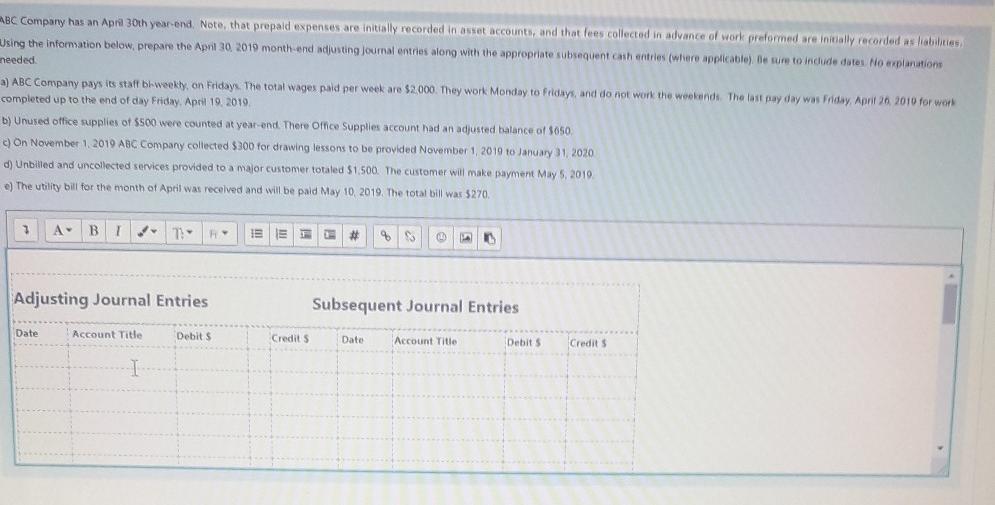

ABC Company has an Apr 30th year-end. Note that prepaid expenses are initially recorded in asset accounts, and that fees collected in advance of work preformed are initially recorded as liabilities Using the information below, prepare the April 30 2019 month-end adjusting Journal entries along with the appropriate subsequent cash entries (where applicable). Be sure to include dates No explanations needed a) ABC Company pays its staff bh weekly, on Friday. The total wages paid per week are $2,000. They work Monday to Fridays, and do not work the weekends. The last day day was Friday, April 26 2010 for work completed up to the end of day Friday, April 19, 2019 b) Unused office supplies of $500 were counted at year-end. There Omce Supplies account had an adjusted balance of 5050 c) On November 1, 2019 ABC Company collected $300 for drawing lessons to be provided November 1, 2019 to January 31, 2020 d) Unbilled and uncollected services provided to a major customer totaled $1.500. The customer will make payment May 5, 2010 e) The utility bill for the month of April was received and will be paid May 10, 2019. The total bill was $270. 7 A B 1 7 2 0 Adjusting Journal Entries Subsequent Journal Entries Date Account Title Debits Credits Date Account Title Debits Credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started