Question

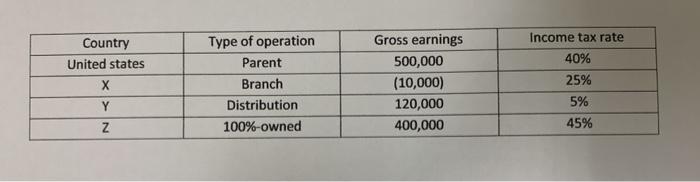

ABC Company has income from the following countries: ABC's subsidiary in Z declares a 40 percent dividend; Z's withholding tax on dividends is 5 percent.

ABC Company has income from the following countries:

ABC's subsidiary in Z declares a 40 percent dividend; Z's withholding tax on dividends is 5 percent. Both the branch and the distribution facility, which is wholly owned, retain all earnings. The distribution earnings are considered to be foreign-based company sales income. What is ABC's final U.S. tax liability?

Country Type of operation Gross earnings Income tax rate United states Parent 500,000 40% Branch (10,000) 25% Y Distribution 120,000 5% 100%-owned 400,000 45%

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Ans gruen dsa ABC Company has income Som The Bossauing Countntes ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting

Authors: Jonathan E. Duchac, James M. Reeve, Carl S. Warren

23rd Edition

978-0324662962

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App