Answered step by step

Verified Expert Solution

Question

1 Approved Answer

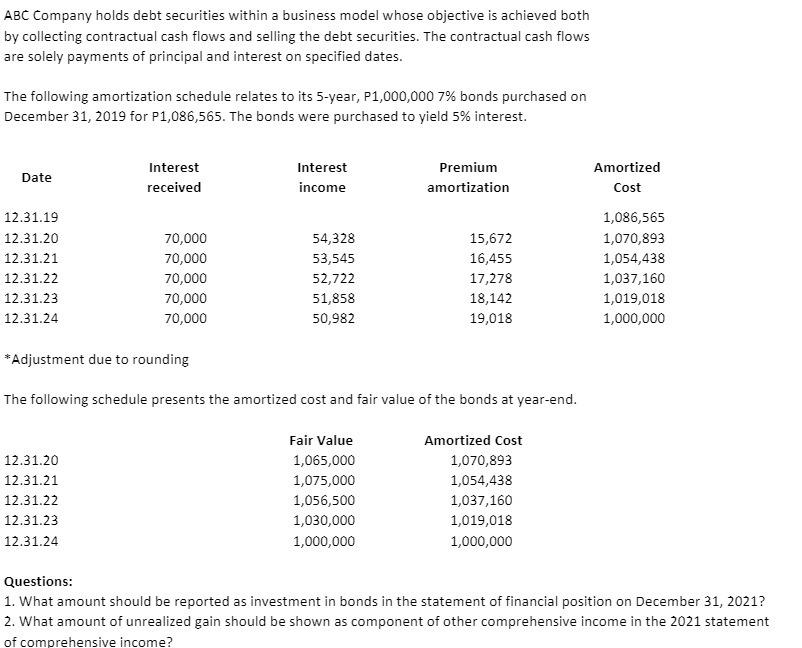

ABC Company holds debt securities within a business model whose objective is achieved both by collecting contractual cash flows and selling the debt securities.

ABC Company holds debt securities within a business model whose objective is achieved both by collecting contractual cash flows and selling the debt securities. The contractual cash flows are solely payments of principal and interest on specified dates. The following amortization schedule relates to its 5-year, P1,000,000 7% bonds purchased on December 31, 2019 for P1,086,565. The bonds were purchased to yield 5% interest. Date 12.31.19 12.31.20 12.31.21 12.31.22 12.31.23 12.31.24 Interest received 12.31.20 12.31.21 12.31.22 12.31.23 12.31.24 70,000 70,000 70,000 70,000 70,000 Interest income 54,328 53,545 52,722 51,858 50,982 Premium amortization Fair Value 1,065,000 1,075,000 1,056,500 1,030,000 1,000,000 15,672 16,455 17,278 *Adjustment due to rounding The following schedule presents the amortized cost and fair value of the bonds at year-end. 18,142 19,018 Amortized Cost 1,070,893 1,054,438 1,037,160 1,019,018 1,000,000 Amortized Cost 1,086,565 1,070,893 1,054,438 1,037,160 1,019,018 1,000,000 Questions: 1. What amount should be reported as investment in bonds in the statement of financial position on December 31, 2021? 2. What amount of unrealized gain should be shown as component of other comprehensive income in the 2021 statement of comprehensive income?

Step by Step Solution

★★★★★

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

1 Investment in Bonds on December 31 2021 The investment in bonds reported on the stateme...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started