Answered step by step

Verified Expert Solution

Question

1 Approved Answer

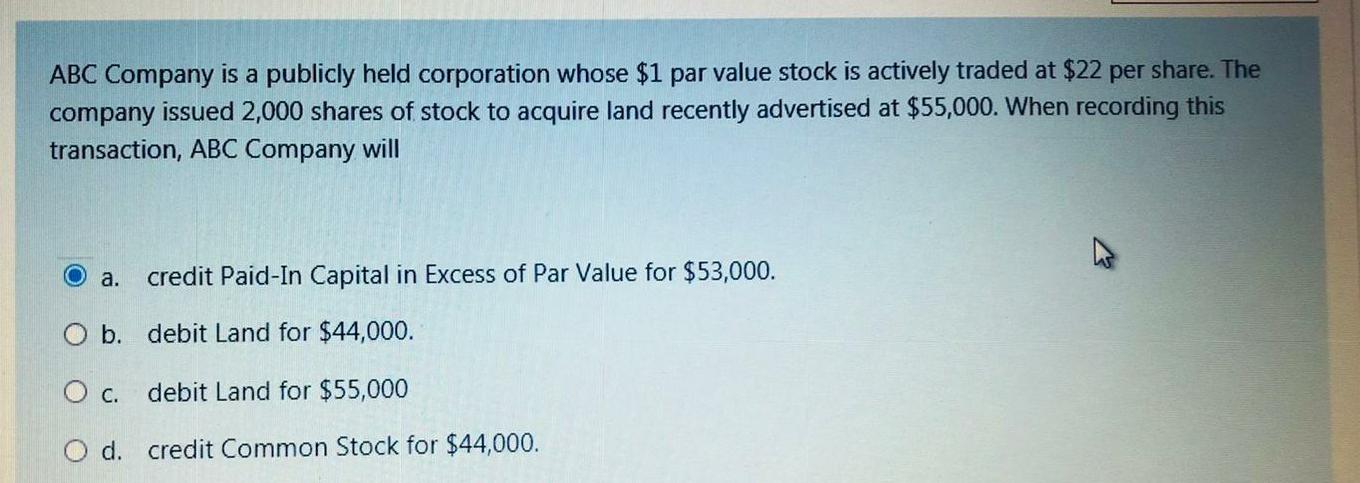

ABC Company is a publicly held corporation whose $1 par value stock is actively traded at $22 per share. The company issued 2,000 shares of

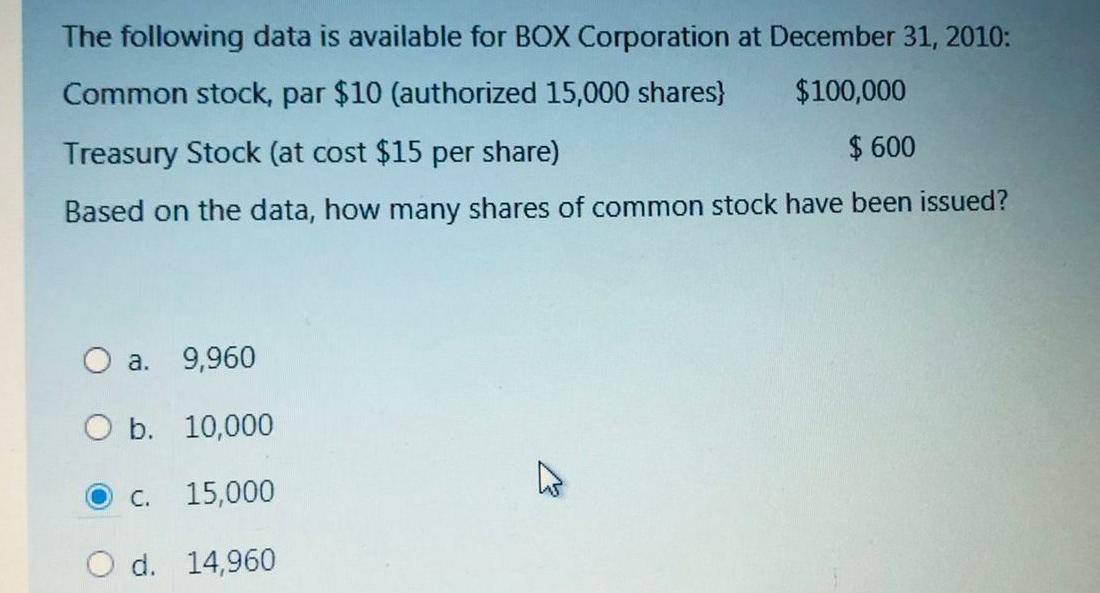

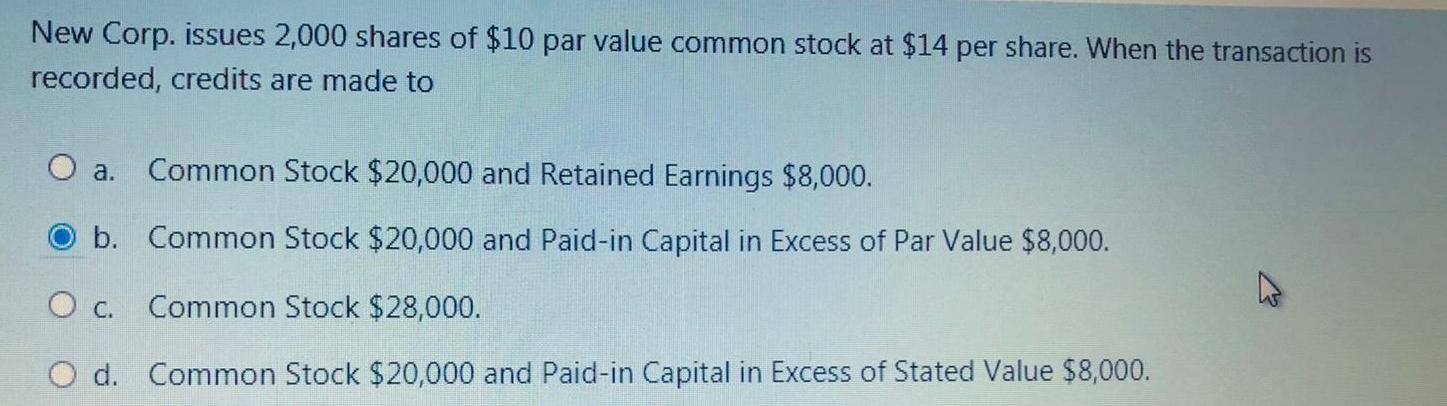

ABC Company is a publicly held corporation whose $1 par value stock is actively traded at $22 per share. The company issued 2,000 shares of stock to acquire land recently advertised at $55,000. When recording this transaction, ABC Company will O a. credit Paid-In Capital in Excess of Par Value for $53,000. O b. debit Land for $44,000. Oc. debit Land for $55,000 O d. credit Common Stock for $44,000. The following data is available for BOX Corporation at December 31, 2010: Common stock, par $10 (authorized 15,000 shares) $100,000 Treasury Stock (at cost $15 per share) $ 600 Based on the data, how many shares of common stock have been issued? O a. 9,960 O b. 10,000 C. 15,000 d. 14,960 New Corp. issues 2,000 shares of $10 par value common stock at $14 per share. When the transaction is recorded, credits are made to O a. Common Stock $20,000 and Retained Earnings $8,000. O b. Common Stock $20,000 and Paid-in Capital in Excess of Par Value $8,000. O c. Common Stock $28,000. O d. Common Stock $20,000 and Paid-in Capital in Excess of Stated Value $8,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started