Answered step by step

Verified Expert Solution

Question

1 Approved Answer

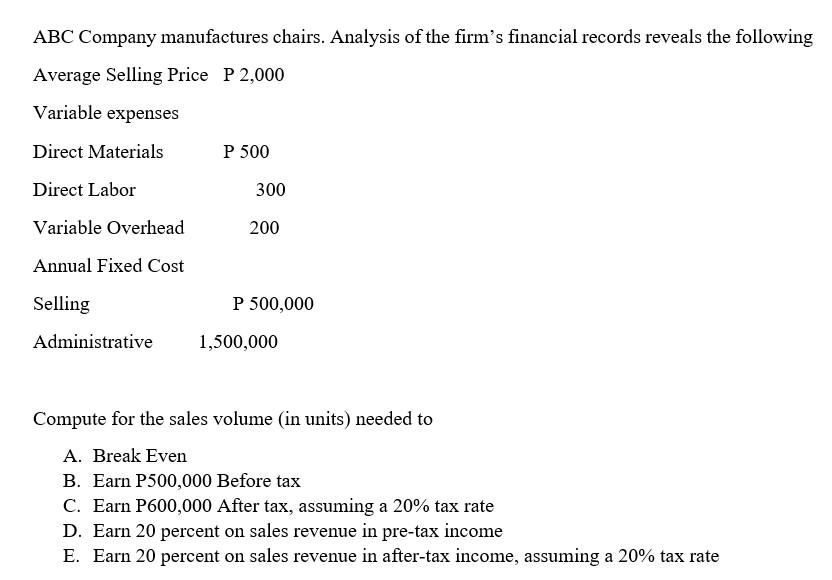

ABC Company manufactures chairs. Analysis of the firm's financial records reveals the following Average Selling Price P 2,000 Variable expenses Direct Materials Direct Labor

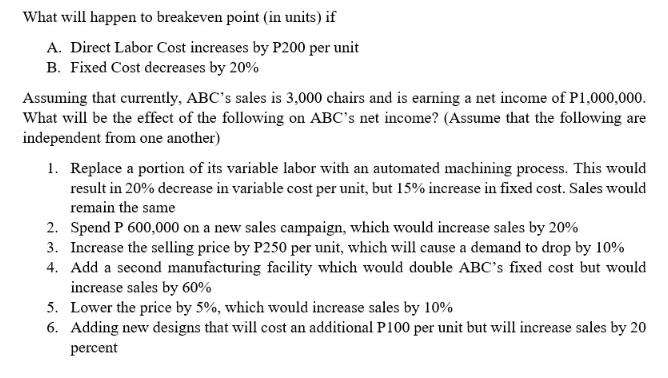

ABC Company manufactures chairs. Analysis of the firm's financial records reveals the following Average Selling Price P 2,000 Variable expenses Direct Materials Direct Labor Variable Overhead Annual Fixed Cost Selling Administrative P 500 300 200 P 500,000 1,500,000 Compute for the sales volume (in units) needed to A. Break Even B. Earn P500,000 Before tax C. Earn P600,000 After tax, assuming a 20% tax rate D. Earn 20 percent on sales revenue in pre-tax income E. Earn 20 percent on sales revenue in after-tax income, assuming a 20% tax rate What will happen to breakeven point (in units) if A. Direct Labor Cost increases by P200 per unit B. Fixed Cost decreases by 20% Assuming that currently, ABC's sales is 3,000 chairs and is earning a net income of P1,000,000. What will be the effect of the following on ABC's net income? (Assume that the following are independent from one another) 1. Replace a portion of its variable labor with an automated machining process. This would result in 20% decrease in variable cost per unit, but 15% increase in fixed cost. Sales would remain the same 2. Spend P 600,000 on a new sales campaign, which would increase sales by 20% 4. 3. Increase the selling price by P250 per unit, which will cause a demand to drop by 10% Add a second manufacturing facility which would double ABC's fixed cost but would increase sales by 60% 5. Lower the price by 5%, which would increase sales by 10% 6. Adding new designs that will cost an additional P100 per unit but will increase sales by 20 percent

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Lets start by calculating the various scenarios step by step Given information Average Selling Price P2000 Variable Expenses Direct Materials P500 Direct Labor P300 Variable Overhead P200 Annual Fixed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started