Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Company manufactures custom-built conveyor systems for factory and commercial operations. The cost accountant for ABC Company is in the process of educating a

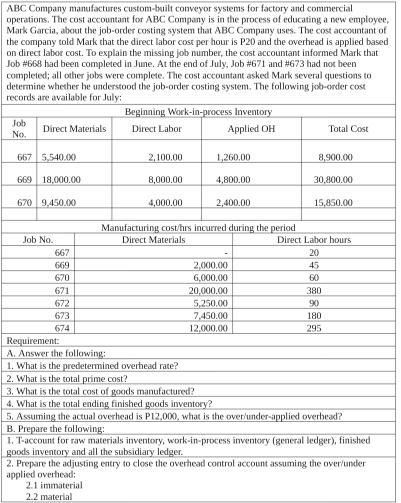

ABC Company manufactures custom-built conveyor systems for factory and commercial operations. The cost accountant for ABC Company is in the process of educating a new employee, Mark Garcia, about the job-order costing system that ABC Company uses. The cost accountant of the company told Mark that the direct labor cost per hour is P20 and the overhead is applied based on direct labor cost. To explain the missing job number, the cost accountant informed Mark that Job # 668 had been completed in June. At the end of July, Job # 671 and # 673 had not been completed; all other jobs were complete. The cost accountant asked Mark several questions to determine whether he understood the job-order costing system. The following job-order cost records are available for July: Job No. Direct Materials 667 5,540.00 669 18,000.00 670 9,450.00 Job No. 667 669 670 671 672 673 674 Beginning Work-in-process Inventory Direct Labor Applied OH 2,100.00 8,000.00 4,000.00 1,260.00 4,800.00 2,400.00 Manufacturing cost/hrs incurred during the period Direct Materials 2,000,00 6,000.00 20,000.00 5,250.00 7,450.00 12,000,00 Total Cost 8,900.00 30,800.00 15,850.00 Direct Labor hours 20 45 60 380 90 180 295 Requirement: A. Answer the following: 1. What is the predetermined overhead rate? 2. What is the total prime cost? 3. What is the total cost of goods manufactured? 4. What is the total ending finished goods inventory? 5. Assuming the actual overhead is P12,000, what is the over/under-applied overhead? B. Prepare the following: 1. T-account for raw materials inventory, work-in-process inventory (general ledger), finished goods inventory and all the subsidiary ledger. 2. Prepare the adjusting entry to close the overhead control account assuming the over/under applied overhead: 2.1 immaterial 2.2 material

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

A Answers to the following questions 1 Predetermined overhead rate Total Manufacturing Overhead Tota...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started