Answered step by step

Verified Expert Solution

Question

1 Approved Answer

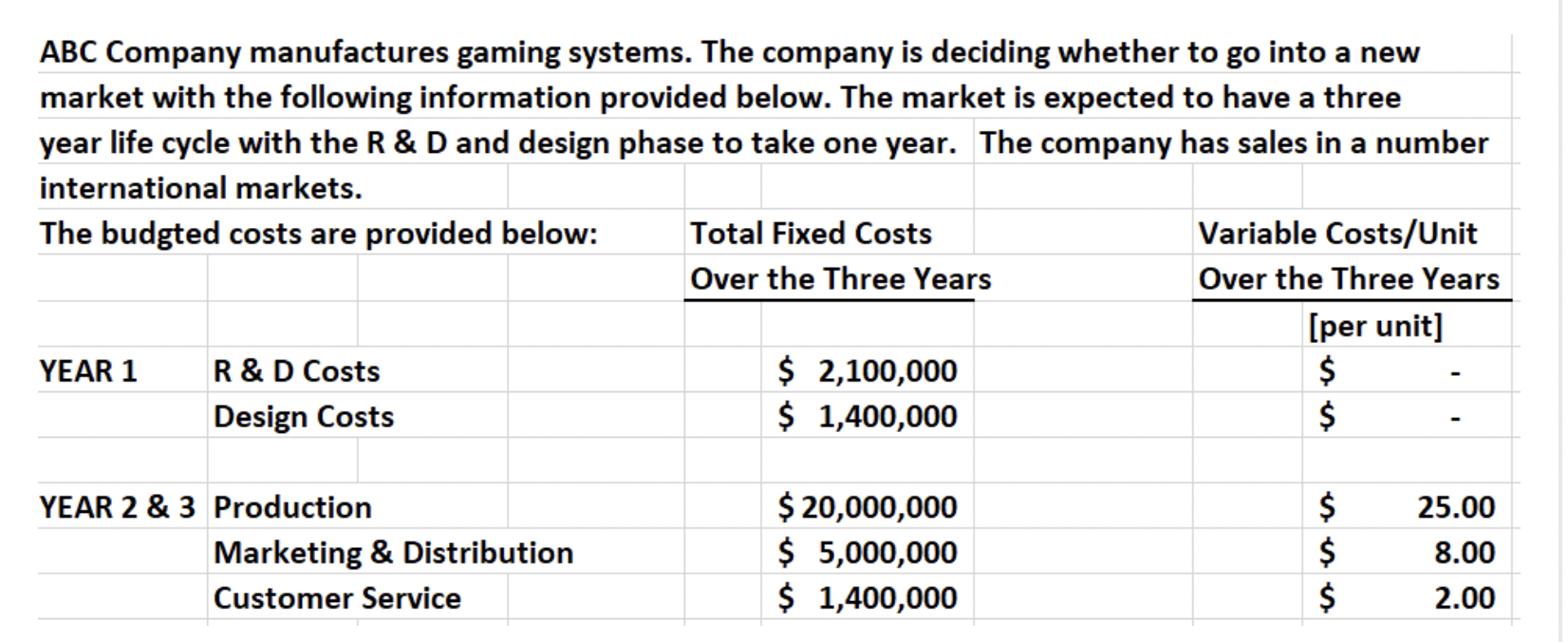

ABC Company manufactures gaming systems. The company is deciding whether to go into a new market with the following information provided below. The market

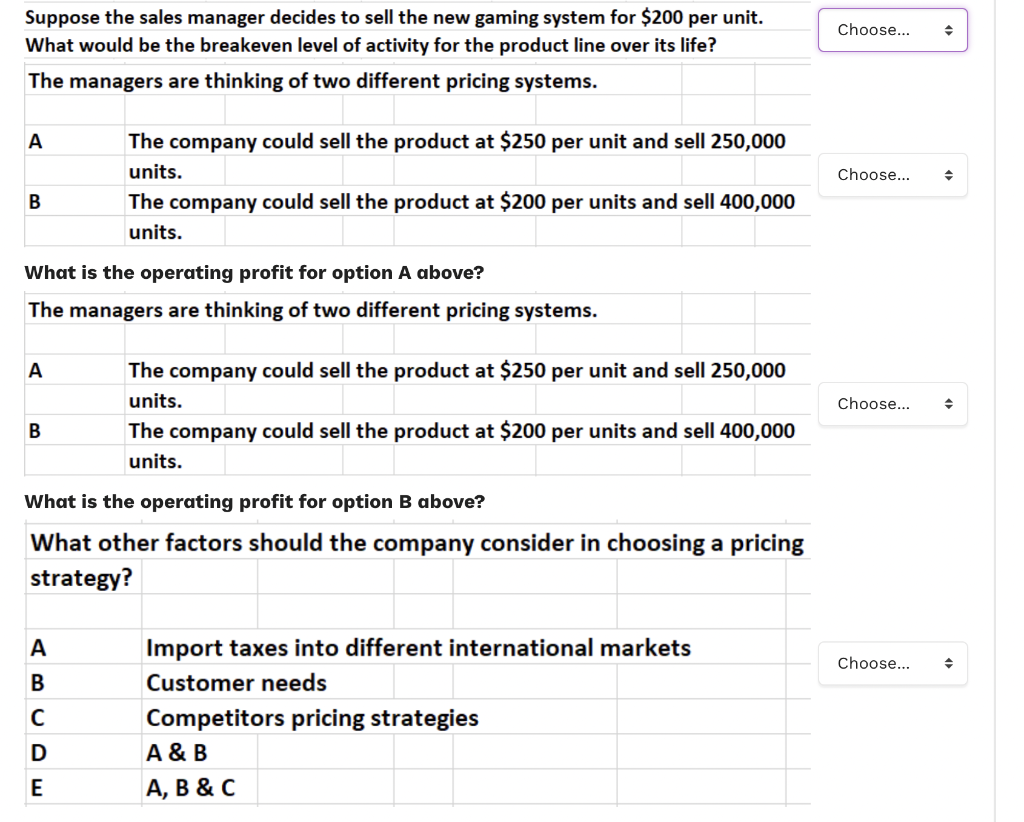

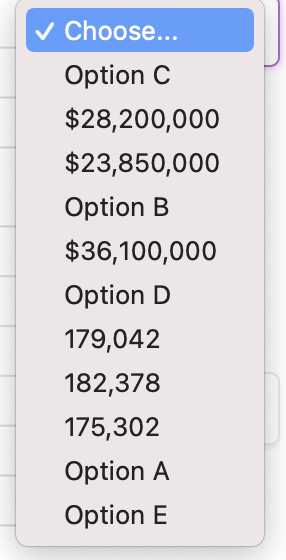

ABC Company manufactures gaming systems. The company is deciding whether to go into a new market with the following information provided below. The market is expected to have a three year life cycle with the R & D and design phase to take one year. The company has sales in a number international markets. The budgted costs are provided below: YEAR 1 R & D Costs Design Costs YEAR 2 & 3 Production Marketing & Distribution Customer Service Total Fixed Costs Over the Three Years $ 2,100,000 $ 1,400,000 $ 20,000,000 $ 5,000,000 $ 1,400,000 Variable Costs/Unit Over the Three Years [per unit] $ $ $ $ $ 25.00 8.00 2.00 Suppose the sales manager decides to sell the new gaming system for $200 per unit. What would be the breakeven level of activity for the product line over its life? The managers are thinking of two different pricing systems. A B A What is the operating profit for option A above? The managers are thinking of two different pricing systems. B The company could sell the product at $250 per unit and sell 250,000 units. The company could sell the product at $200 per units and sell 400,000 units. ABCDE The company could sell the product at $250 per unit and sell 250,000 units. The company could sell the product at $200 per units and sell 400,000 units. What is the operating profit for option B above? What other factors should the company consider in choosing a pricing strategy? Import taxes into different international markets Customer needs Competitors pricing strategies A & B A, B & C Choose... Choose... Choose... Choose... Choose... Option C $28,200,000 $23,850,000 Option B $36,100,000 Option D 179,042 182,378 175,302 Option A Option E

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started