Answered step by step

Verified Expert Solution

Question

1 Approved Answer

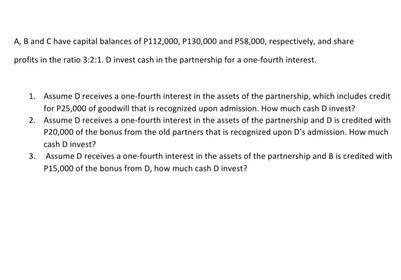

A, B and C have capital balances of P112,000, P130,000 and P58,000, respectively, and share profits in the ratio 3:2:1. D invest cash in

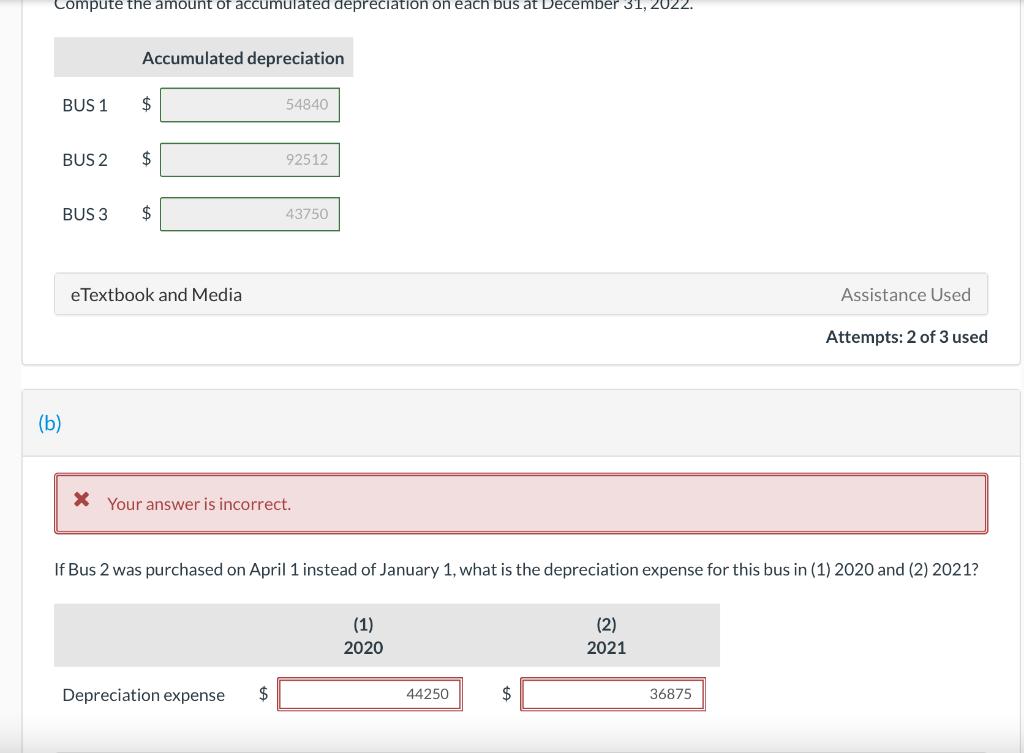

A, B and C have capital balances of P112,000, P130,000 and P58,000, respectively, and share profits in the ratio 3:2:1. D invest cash in the partnership for a one-fourth interest. 1. Assume D receives a one-fourth interest in the assets of the partnership, which includes credit for P25,000 of goodwill that is recognized upon admission. How much cash D invest? 2. Assume D receives a one-fourth interest in the assets of the partnership and D is credited with P20,000 of the bonus from the old partners that is recognized upon D's admission. How much cash D invest? 3. Assume D receives a one-fourth interest in the assets of the partnership and B is credited with P15,000 of the bonus from D, how much cash D invest? Compute the amount of accumulated depreciation on each bus at December 31, 2022. (b) BUS 1 BUS 2 BUS 3 Accumulated depreciation $ $ $ eTextbook and Media 54840 92512 Depreciation expense $ 43750 * Your answer is incorrect. If Bus 2 was purchased on April 1 instead of January 1, what is the depreciation expense for this bus in (1) 2020 and (2) 2021? (1) 2020 44250 $ (2) 2021 Assistance Used Attempts: 2 of 3 used 36875

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started