Answered step by step

Verified Expert Solution

Question

1 Approved Answer

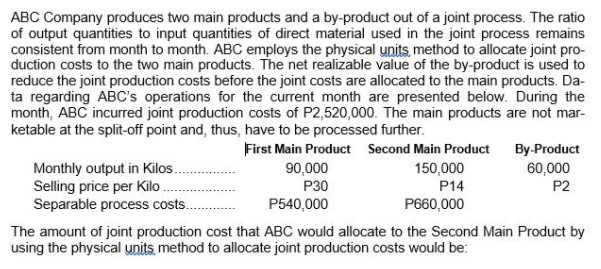

ABC Company produces two main products and a by-product out of a joint process. The ratio of output quantities to input quantities of direct

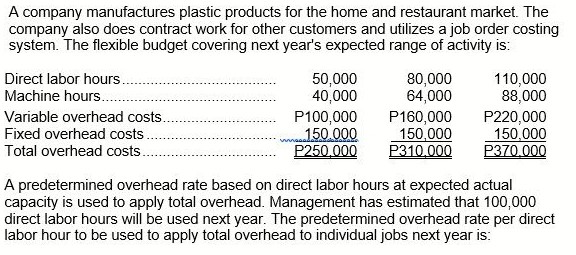

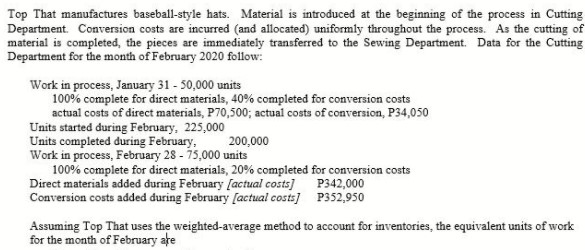

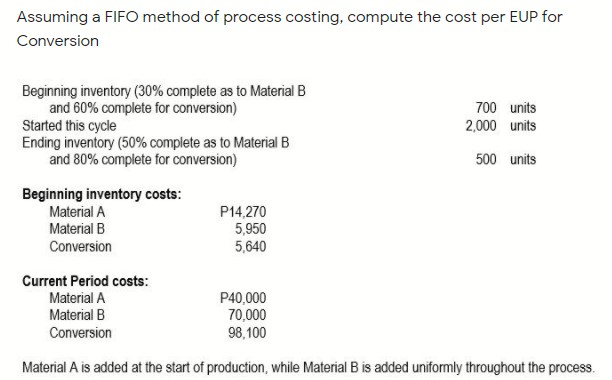

ABC Company produces two main products and a by-product out of a joint process. The ratio of output quantities to input quantities of direct material used in the joint process remains consistent from month to month. ABC employs the physical units, method to allocate joint pro- duction costs to the two main products. The net realizable value of the by-product is used to reduce the joint production costs before the joint costs are allocated to the main products. Da- ta regarding ABC's operations for the current month are presented below. During the month, ABC incurred joint production costs of P2,520,000. The main products are not mar- ketable at the split-off point and, thus, have to be processed further. Monthly output in Kilos.. Selling price per kilo.. Separable process costs.. First Main Product Second Main Product 90,000 P30 P540,000 150,000 P14 P660,000 By-Product 60,000 P2 The amount of joint production cost that ABC would allocate to the Second Main Product by using the physical units method to allocate joint production costs would be: A company manufactures plastic products for the home and restaurant market. The company also does contract work for other customers and utilizes a job order costing system. The flexible budget covering next year's expected range of activity is: 110,000 Direct labor hours.. Machine hours.. Variable overhead costs. Fixed overhead costs Total overhead costs... 50,000 80,000 40,000 64,000 88,000 P100,000 P160,000 P220,000 150.000 150,000 150,000 P250,000 P310,000 P370.000 A predetermined overhead rate based on direct labor hours at expected actual capacity is used to apply total overhead. Management has estimated that 100,000 direct labor hours will be used next year. The predetermined overhead rate per direct labor hour to be used to apply total overhead to individual jobs next year is: Top That manufactures baseball-style hats. Material is introduced at the beginning of the process in Cutting Department. Conversion costs are incurred (and allocated) uniformly throughout the process. As the cutting of material is completed, the pieces are immediately transferred to the Sewing Department. Data for the Cutting Department for the month of February 2020 follow: Work in process, January 31 - 50,000 units 100% complete for direct materials, 40% completed for conversion costs actual costs of direct materials, P70,500; actual costs of conversion, P34,050 Units started during February, 225,000 Units completed during February, 200,000 Work in process, February 28 - 75,000 units 100% complete for direct materials, 20% completed for conversion costs Direct materials added during February [actual costs] Conversion costs added during February [actual costs] P342,000 P352,950 Assuming Top That uses the weighted-average method to account for inventories, the equivalent units of work for the month of February are Assuming a FIFO method of process costing, compute the cost per EUP for Conversion Beginning inventory (30% complete as to Material B and 60% complete for conversion) Started this cycle Ending inventory (50% complete as to Material B and 80% complete for conversion) Beginning inventory costs: Material A Material B Conversion P14,270 5,950 5,640 Current Period costs: Material A P40,000 Material B 70,000 Conversion 98,100 700 units 2,000 units 500 units Material A is added at the start of production, while Material B is added uniformly throughout the process.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started