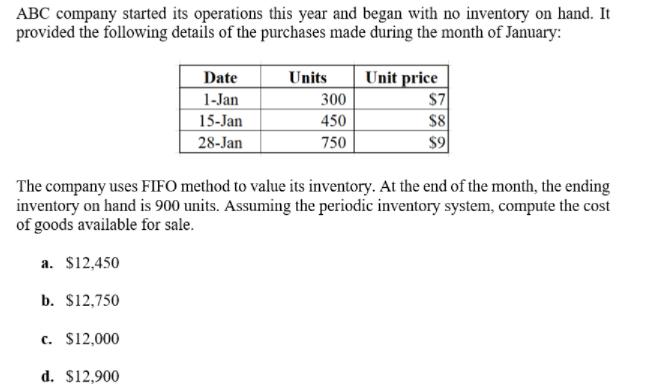

ABC company started its operations this year and began with no inventory on hand. It provided the following details of the purchases made during

ABC company started its operations this year and began with no inventory on hand. It provided the following details of the purchases made during the month of January: Unit price S7 $8 $9 Date Units 1-Jan 300 15-Jan 450 28-Jan 750 The company uses FIFO method to value its inventory. At the end of the month, the ending inventory on hand is 900 units. Assuming the periodic inventory system, compute the cost of goods available for sale. a. $12,450 b. $12,750 c. $12,000 d. $12,900 ABC company started its operations this year and began with no inventory on hand. It provided the following details of the purchases made during the month of January: Date Unit price $7 $8 $9 Units 1-Jan 300 15-Jan 450 28-Jan 750 The company uses weighted-average method of inventory valuation to value its inventory. At the end of the month, the ending inventory on hand is 900 units. Assuming the periodic inventory system, compute the value of the ending inventory for the month. a. $7,650 b. $7,470 c. $7,830 d. $6,570

Step by Step Solution

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 Cost of beginning inventory 0 Total cost of ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started