Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Company started their business on July 1, 2020. ABC Company had two employees in the year 2020: Jane and Larry. The payroll is run

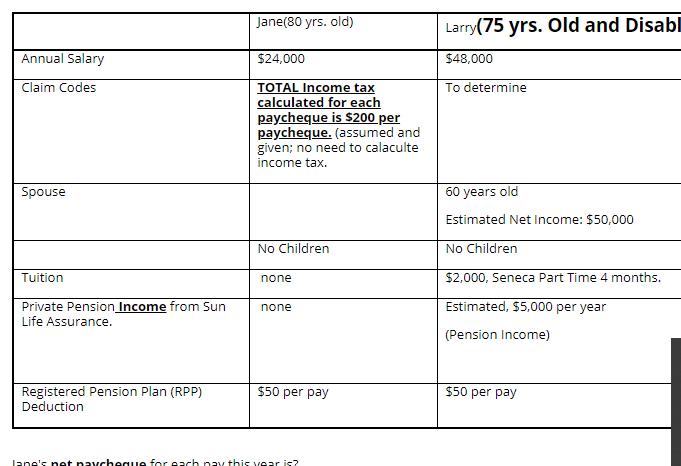

ABC Company started their business on July 1, 2020. ABC Company had two employees in the year 2020: Jane and Larry. The payroll is run semi-monthly. Larry estimates that his 2020 net income will be $10,000 for TD-1 purposes. Assume Jane and Larry work the entire period from July 1 to December 31, 2020 or 6 month. The following payroll data was provided for Jane and Larry:

What is Jane's net paycheque for each pay this year?

Jane(80 yrs. old) Larry(75 yrs. Old and Disabl Annual Salary $24,000 $48,000 Claim Codes To determine TOTAL Income tax calculated for each paycheque is $200 per paycheque. (assumed and given; no need to calaculte income tax. Spouse 60 years old Estimated Net Income: $50,000 No Children No Children Tuition none $2,000, Seneca Part Time 4 months. Private Pension Income from Sun Estimated, $5,000 per year none Life Assurance. (Pension Income) $50 per pay Registered Pension Plan (RPP) Deduction $50 per pay Jane's net navchegue for each pay this vear is?

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Solution Jane Annual Salary 24000 Monthly ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started