Question

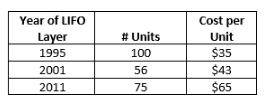

ABC Company uses a LIFO cost flow assumption for it inventory of tires and at the start of 2020 had the following beginning inventory layers:

ABC Company uses a LIFO cost flow assumption for it inventory of tires and at the start of 2020 had the following beginning inventory layers:

During 2020 ABC was not able to purchase as many tires as it sold resulting in the need to include in cost of goods sold the cost of 95 units of its beginning inventory. The price of tires purchased in 2020 held constant throughout the year at $78 per tire.

1. How much would ABC report as LIFO liquidation in its 2020 financial statements?

2. As a financial analyst assigned to produce a detailed report on the results of operations for ABC in 2020, knowledge of the liquidation would results in you adjusting which ratio(s) in your report? Explain precisely how you would adjust the ratio(s) and the impact on the ratio(s) of your adjustment.

Year of LIFO Cost per Layer # Units Unit $35 $43 1995 100 2001 56 2011 75 $65

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Dear as the company follows LIFO method cost of beginning i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started