ABC Corp had accounting income of $172,330 in Year 1. Included in the calculation of that amount is the CEO's life insurance expense of

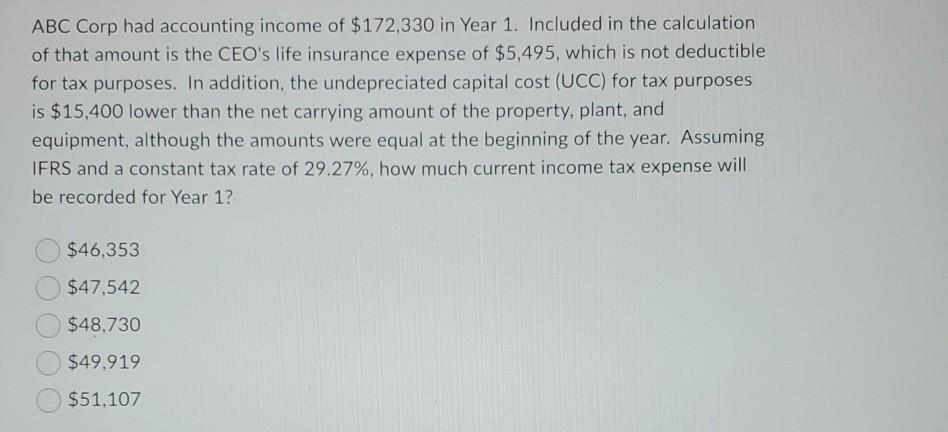

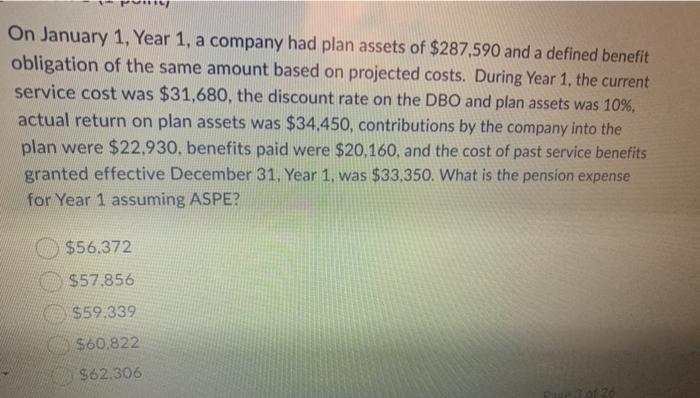

ABC Corp had accounting income of $172,330 in Year 1. Included in the calculation of that amount is the CEO's life insurance expense of $5,495, which is not deductible for tax purposes. In addition, the undepreciated capital cost (UCC) for tax purposes is $15,400 lower than the net carrying amount of the property, plant, and equipment, although the amounts were equal at the beginning of the year. Assuming IFRS and a constant tax rate of 29.27%, how much current income tax expense will be recorded for Year 1? $46,353 $47,542 $48,730 $49,919 $51,107 On January 1, Year 1, a company had plan assets of $287,590 and a defined benefit obligation of the same amount based on projected costs. During Year 1, the current service cost was $31,680, the discount rate on the DB0 and plan assets was 10%, actual return on plan assets was $34,450, contributions by the company into the plan were $22,930, benefits paid were $20,160, and the cost of past service benefits granted effective December 31, Year 1, was $33,350. What is the pension expense for Year 1 assuming ASPE? $56.372 $57.856 $59.339 $60.822 $62.306 3of 26

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60d5e1d221cd6_208265.pdf

180 KBs PDF File

60d5e1d221cd6_208265.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started