Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Corp. is a calendar year, accrual basis taxpayer. ABC sells, installs, and services computer systems and networks. It has an audited financial statements

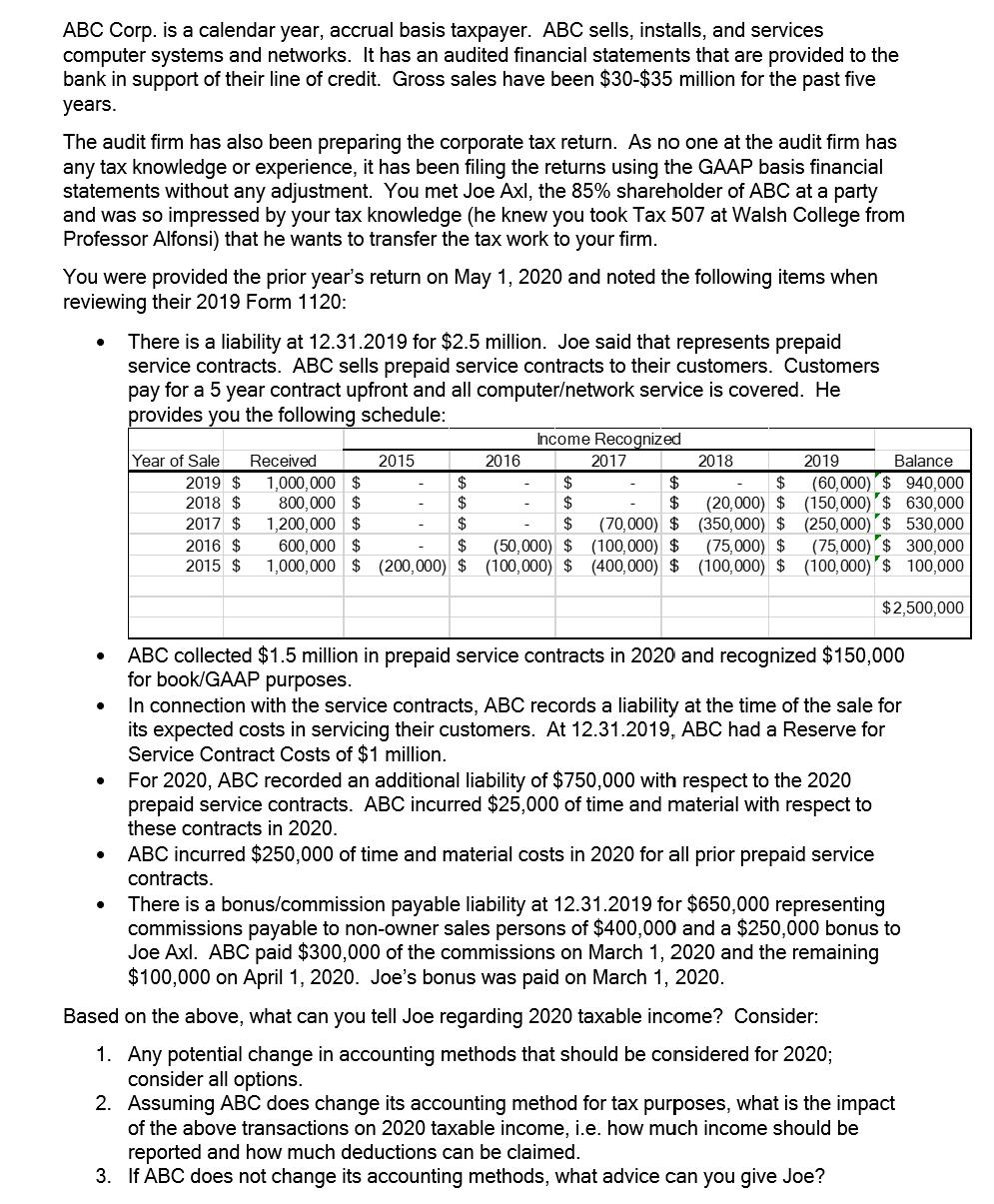

ABC Corp. is a calendar year, accrual basis taxpayer. ABC sells, installs, and services computer systems and networks. It has an audited financial statements that are provided to the bank in support of their line of credit. Gross sales have been $30-$35 million for the past five years. The audit firm has also been preparing the corporate tax return. As no one at the audit firm has any tax knowledge or experience, it has been filing the returns using the GAAP basis financial statements without any adjustment. You met Joe Axl, the 85% shareholder of ABC at a party and was so impressed by your tax knowledge (he knew you took Tax 507 at Walsh College from Professor Alfonsi) that he wants to transfer the tax work to your firm. You were provided the prior year's return on May 1, 2020 and noted the following items when reviewing their 2019 Form 1120: There is a liability at 12.31.2019 for $2.5 million. Joe said that represents prepaid service contracts. ABC sells prepaid service contracts to their customers. Customers pay for a 5 year contract upfront and all computer/network service is covered. He provides you the following schedule: Income Recognized Year of Sale Received 2015 2016 2017 2018 2019 2019 $ 1,000,000 $ $ $ $ $ Balance (60,000) $940,000 2018 $ 800,000 $ $ $ $ (20,000) $ (150,000) $ 630,000 2017 $ 1,200,000 $ $ $ (70,000) $ (350,000) $ (250,000) $530,000 2016 $ 600,000 $ $ 2015 $ 1,000,000 $ (200,000) $ (50,000) $ (100,000) $ (100,000) $ (400,000) $ (75,000) $ (100,000) $ (75,000) $ 300,000 (100,000) $ 100,000 $2,500,000 ABC collected $1.5 million in prepaid service contracts in 2020 and recognized $150,000 for book/GAAP purposes. In connection with the service contracts, ABC records a liability at the time of the sale for its expected costs in servicing their customers. At 12.31.2019, ABC had a Reserve for Service Contract Costs of $1 million. For 2020, ABC recorded an additional liability of $750,000 with respect to the 2020 prepaid service contracts. ABC incurred $25,000 of time and material with respect to these contracts in 2020. ABC incurred $250,000 of time and material costs in 2020 for all prior prepaid service contracts. There is a bonus/commission payable liability at 12.31.2019 for $650,000 representing commissions payable to non-owner sales persons of $400,000 and a $250,000 bonus to Joe AxI. ABC paid $300,000 of the commissions on March 1, 2020 and the remaining $100,000 on April 1, 2020. Joe's bonus was paid on March 1, 2020. Based on the above, what can you tell Joe regarding 2020 taxable income? Consider: 1. Any potential change in accounting methods that should be considered for 2020; consider all options. 2. Assuming ABC does change its accounting method for tax purposes, what is the impact of the above transactions on 2020 taxable income, i.e. how much income should be reported and how much deductions can be claimed. 3. If ABC does not change its accounting methods, what advice can you give Joe?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started