Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC CORP. is a holder of a franchise to sell water in a particular locality. During the last quarter, it had the following gross

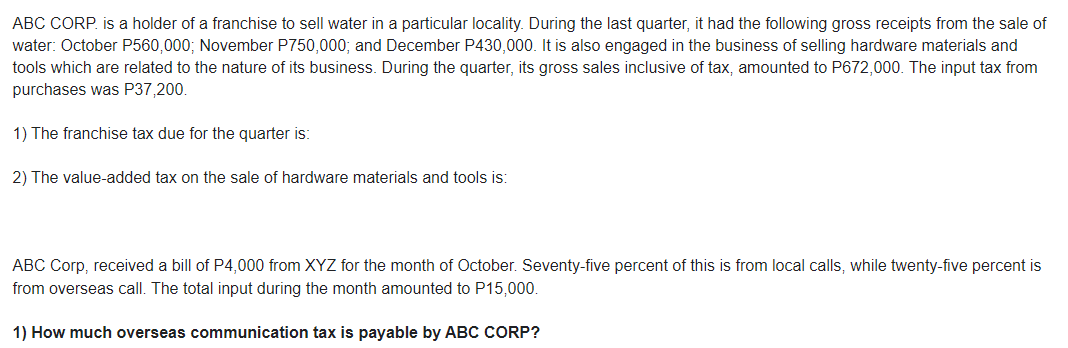

ABC CORP. is a holder of a franchise to sell water in a particular locality. During the last quarter, it had the following gross receipts from the sale of water: October P560,000; November P750,000; and December P430,000. It is also engaged in the business of selling hardware materials and tools which are related to the nature of its business. During the quarter, its gross sales inclusive of tax, amounted to P672,000. The input tax from purchases was P37,200. 1) The franchise tax due for the quarter is: 2) The value-added tax on the sale of hardware materials and tools is: ABC Corp, received a bill of P4,000 from XYZ for the month of October. Seventy-five percent of this is from local calls, while twenty-five percent is from overseas call. The total input during the month amounted to P15,000. 1) How much overseas communication tax is payable by ABC CORP?

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 To compute the franchise tax due for the quarter youll need to sum up the gross receipts from the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started