Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Corp. is considering purchasing a machine costing $65,000. The useful life of the machine is 4 years and has no residual value. The physical

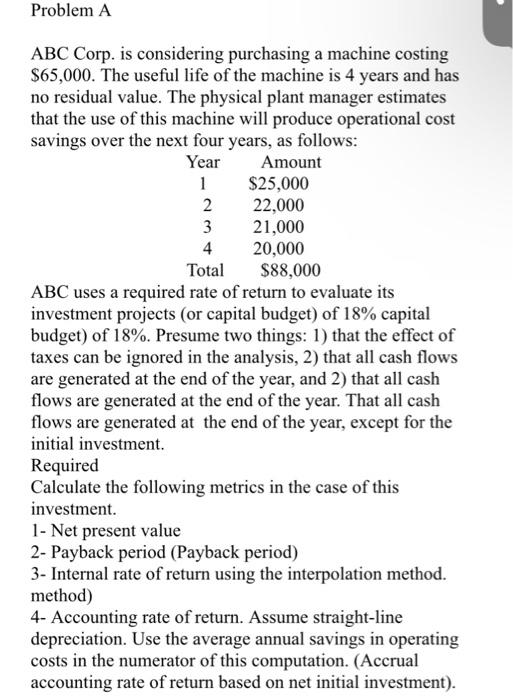

ABC Corp. is considering purchasing a machine costing $65,000. The useful life of the machine is 4 years and has no residual value. The physical plant manager estimates that the use of this machine will produce operational cost savings over the next four years, as follows: ABC uses a required rate of return to evaluate its investment projects (or capital budget) of 18% capital budget) of 18%. Presume two things: 1) that the effect of taxes can be ignored in the analysis, 2) that all cash flows are generated at the end of the year, and 2) that all cash flows are generated at the end of the year. That all cash flows are generated at the end of the year, except for the initial investment. Required Calculate the following metrics in the case of this investment. 1- Net present value 2- Payback period (Payback period) 3- Internal rate of return using the interpolation method. method) 4- Accounting rate of return. Assume straight-line depreciation. Use the average annual savings in operating costs in the numerator of this computation. (Accrual accounting rate of return based on net initial investment)

ABC Corp. is considering purchasing a machine costing $65,000. The useful life of the machine is 4 years and has no residual value. The physical plant manager estimates that the use of this machine will produce operational cost savings over the next four years, as follows: ABC uses a required rate of return to evaluate its investment projects (or capital budget) of 18% capital budget) of 18%. Presume two things: 1) that the effect of taxes can be ignored in the analysis, 2) that all cash flows are generated at the end of the year, and 2) that all cash flows are generated at the end of the year. That all cash flows are generated at the end of the year, except for the initial investment. Required Calculate the following metrics in the case of this investment. 1- Net present value 2- Payback period (Payback period) 3- Internal rate of return using the interpolation method. method) 4- Accounting rate of return. Assume straight-line depreciation. Use the average annual savings in operating costs in the numerator of this computation. (Accrual accounting rate of return based on net initial investment) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started