Answered step by step

Verified Expert Solution

Question

1 Approved Answer

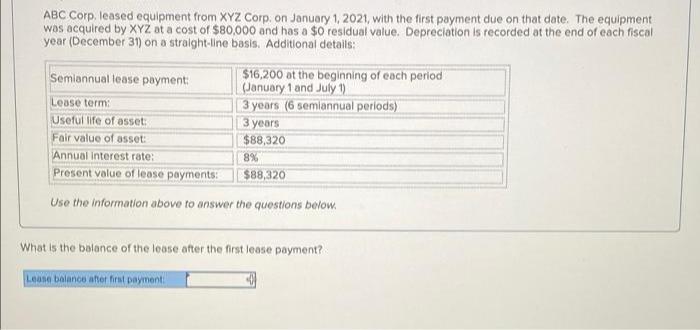

ABC Corp. leased equipment from XYZ Corp. on January 1, 2021, with the first payment due on that date. The equipment was acquired by

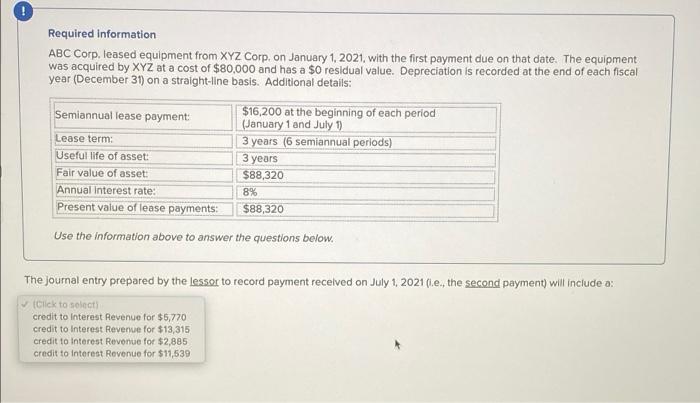

ABC Corp. leased equipment from XYZ Corp. on January 1, 2021, with the first payment due on that date. The equipment was acquired by XY at a cost of $80,000 and has a $0 residual value. Depreciation is recorded at the end of each fiscal year (December 31) on a straight-line basis. Additional detalls: $16,200 at the beginning of each period (January 1 and July 1) 3 years (6 semiannual periods) ears $88,320 Semiannual lease payment: Lease term: Useful life of asset: Fair value of asset: Annual Interest rate: Present value of lease payments: 8% $88,320 Use the information above to answer the questions below. What is the balance of the lease after the first lease payment? Lease balance after first payment Required information ABC Corp. leased equipment from XYZ Corp, on January 1, 2021, with the first payment due on that date. The equipment was acquired by XYZ at a cost of $80,000 and has a $0 residual value. Depreciation is recorded at the end of each fiscal year (December 31) on a straight-line basis. Additional details: $16,200 at the beginning of each period (January 1 and July 1) 3 years (6 semiannual perlods) Semiannual lease payment: Lease term: Useful life of asset: 3 ars Fair value of asset Annual Interest rate: Present value of lease payments: $88,320 8% $88,320 Use the information above to answer the questions below. The journal entry prepared by the lessor to record payment recelved on July 1, 2021 (.e., the second payment) will include a: v (Click to select) credit to Interest Revenue for $5,770 credit to Interest Revenue for $13,315 credit to Interest Revenue for $2,885 credit to Interest Revenue for $11,539

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Requirement 1 Answer Credit to lease payable 122667 The co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started