Answered step by step

Verified Expert Solution

Question

1 Approved Answer

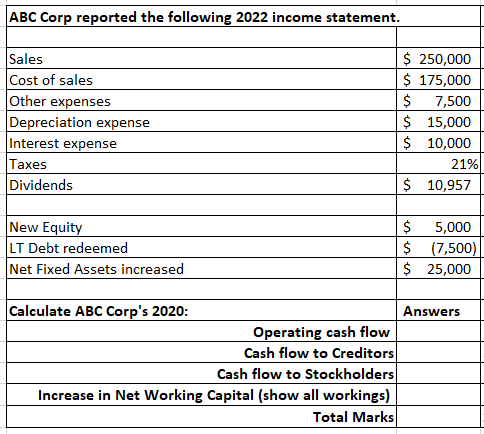

ABC Corp reported the following 2022 income statement. Sales Cost of sales Other expenses Depreciation expense Interest expense Taxes Dividends New Equity LT Debt

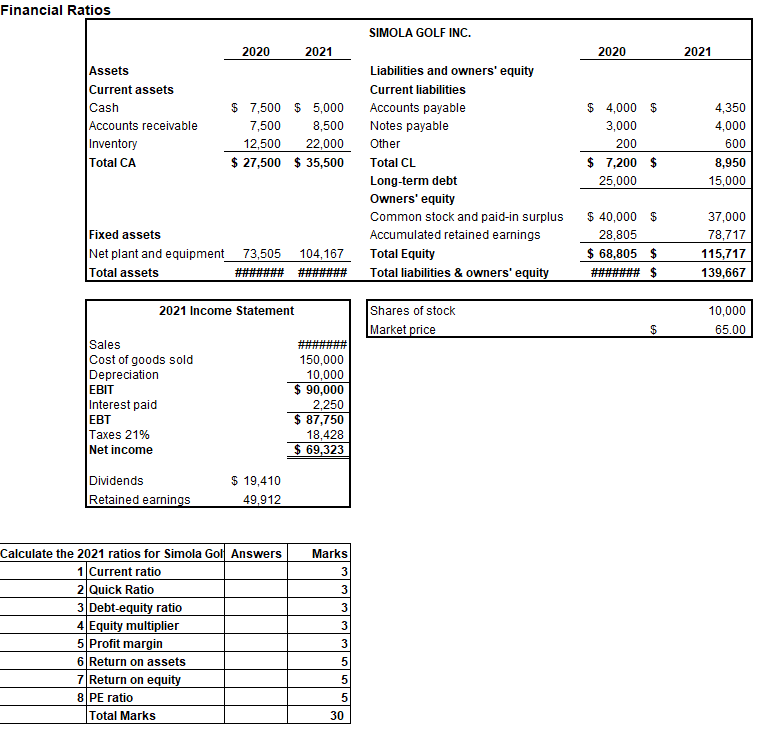

ABC Corp reported the following 2022 income statement. Sales Cost of sales Other expenses Depreciation expense Interest expense Taxes Dividends New Equity LT Debt redeemed Net Fixed Assets increased $ 250,000 $ 175,000 $ 7,500 $ 15,000 $ 10,000 $ 10,957 $ 5,000 21% $ (7,500) $ 25,000 Calculate ABC Corp's 2020: Operating cash flow Cash flow to Creditors Cash flow to Stockholders Increase in Net Working Capital (show all workings) Total Marks Answers Financial Ratios SIMOLA GOLF INC. 2020 2021 2020 2021 Assets Current assets Liabilities and owners' equity Current liabilities Cash $ 7,500 $ 5,000 Accounts payable $ 4,000 $ 4,350 Accounts receivable Inventory 7,500 12,500 8,500 Notes payable 22,000 Other 3,000 200 4,000 600 Total CA $ 27,500 $ 35,500 Total CL $ 7,200 $ 8,950 Long-term debt 25,000 15,000 Owners' equity Common stock and paid-in surplus $ 40,000 $ 37,000 Fixed assets Accumulated retained earnings 28,805 78,717 Net plant and equipment 73,505 104,167 Total Equity $ 68,805 $ 115,717 Total assets ####### ####### Total liabilities & owners' equity ####### $ 139,667 2021 Income Statement Shares of stock Market price 10,000 $ 65.00 Sales Cost of goods sold Depreciation 150,000 10,000 EBIT $ 90,000 Interest paid EBT Taxes 21% Net income 2,250 $ 87,750 18,428 $ 69,323 Dividends Retained earnings $ 19,410 49,912 Calculate the 2021 ratios for Simola Gol Answers 1 Current ratio 2 Quick Ratio 3 Debt-equity ratio 4 Equity multiplier 5 Profit margin 6 Return on assets 7 Return on equity 8 PE ratio Total Marks Marks 3 3 3 3 3 5 5 5 30

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started