Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Corporation has a machine that requires repairs or should be replaced. ABC has evaluated the two options and calculated the cash flows resulting from

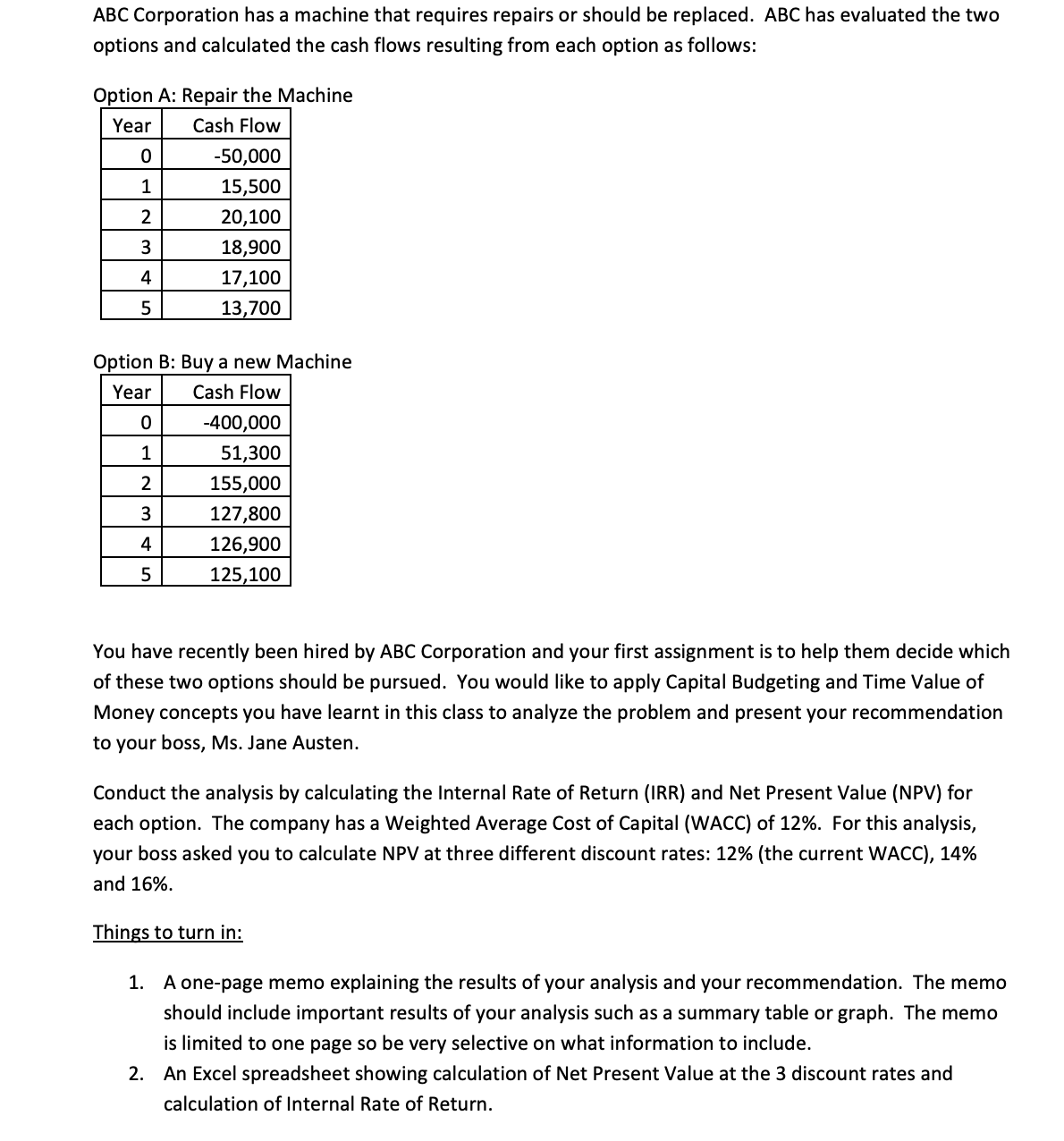

ABC Corporation has a machine that requires repairs or should be replaced. ABC has evaluated the two

options and calculated the cash flows resulting from each option as follows:

Option A: Repair the Machine

Option B: Buy a new Machine

You have recently been hired by ABC Corporation and your first assignment is to help them decide which

of these two options should be pursued. You would like to apply Capital Budgeting and Time Value of

Money concepts you have learnt in this class to analyze the problem and present your recommendation

to your boss, Ms Jane Austen.

Conduct the analysis by calculating the Internal Rate of Return IRR and Net Present Value NPV for

each option. The company has a Weighted Average Cost of Capital WACC of For this analysis,

your boss asked you to calculate NPV at three different discount rates: the current WACC

and

Things to turn in:

A onepage memo explaining the results of your analysis and your recommendation. The memo

should include important results of your analysis such as a summary table or graph. The memo

is limited to one page so be very selective on what information to include.

An Excel spreadsheet showing calculation of Net Present Value at the discount rates and

calculation of Internal Rate of Return.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started