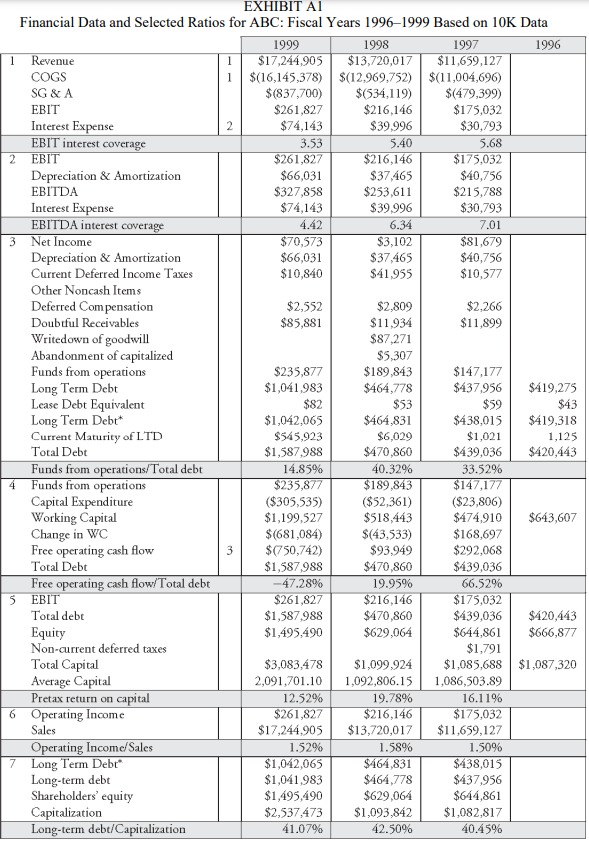

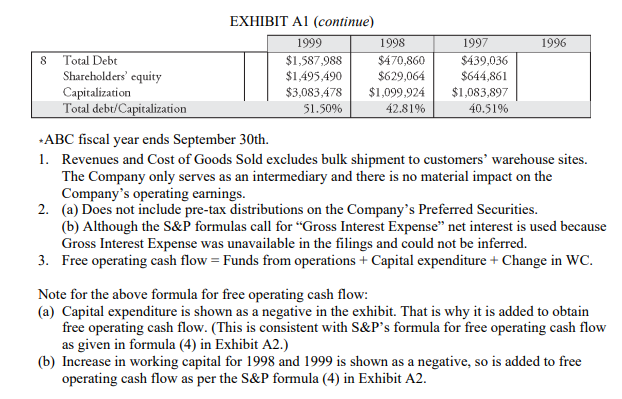

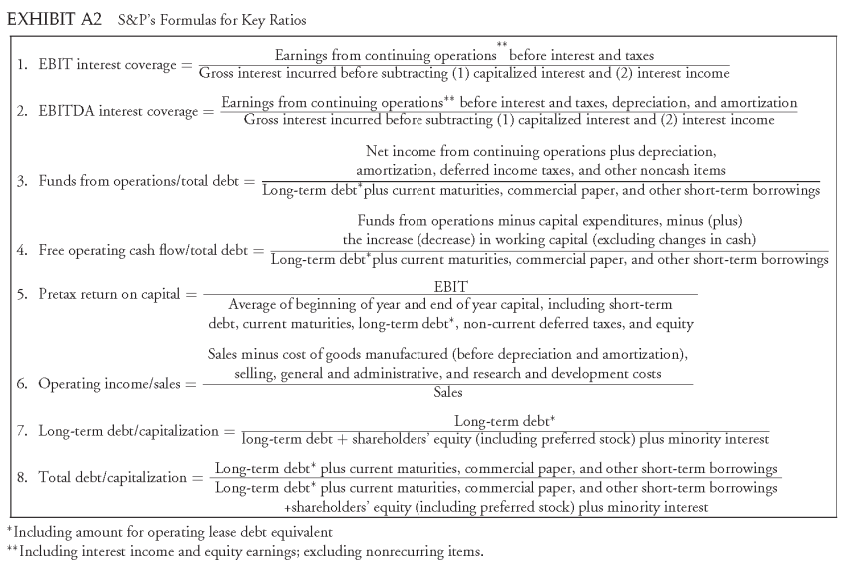

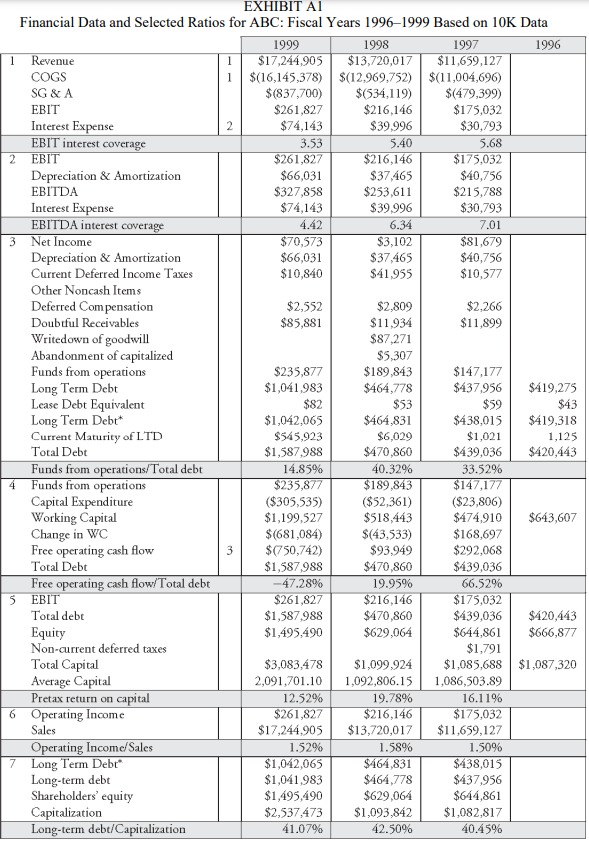

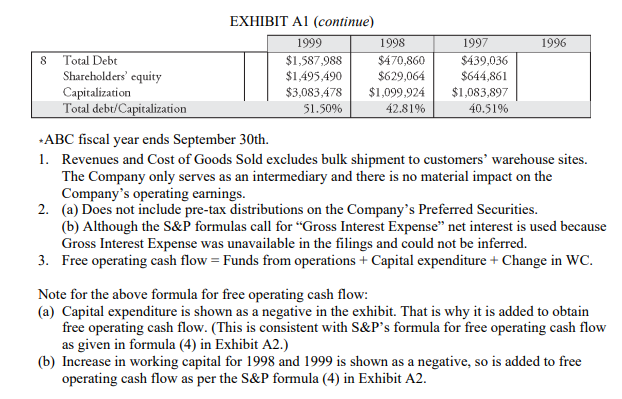

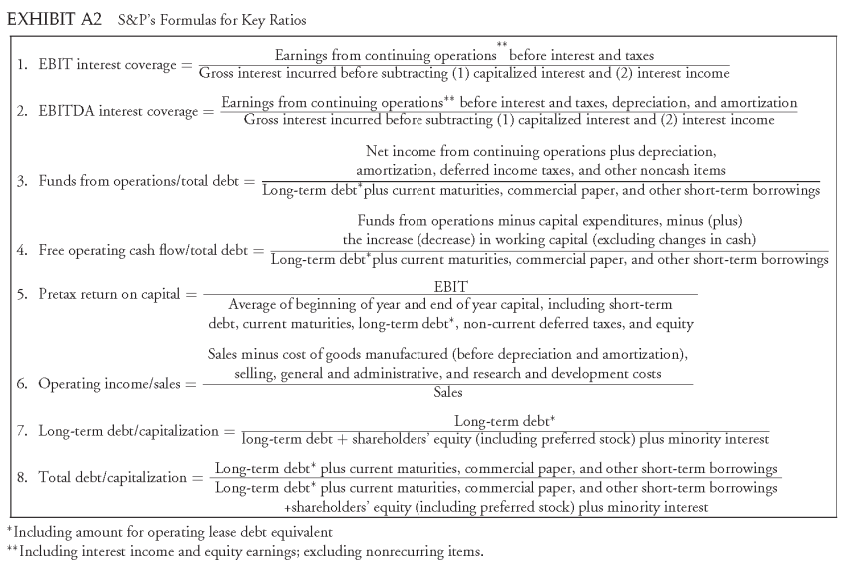

ABC Corporation is a supply channel management company that provides pharmaceuticals, medical-surgical supplies, and specialty products. The company also provides information management solutions and outsourcing services, as well as develops disease-specific treatment protocols and pharmaco-economic initiatives to assist in the reduction of health care costs. Exhibit A1 shows the financial data for the 19961999 fiscal years and various financial ratios. (The financial ratios are shaded in the exhibit.) The companys fiscal year ends on September 30th. Since each rating agency uses slightly different inputs for the ratios it computes, we have included the ratio definitions used by S&P in Exhibit A2. The original corporate bond rating was BBB+. S&P reviewed the companys credit rating in December 1999. Based on the traditional financial ratio analysis, would you recommend ABC Corporation be upgraded, downgraded, or remain stable? And why? Be sure to discuss what could have happened to ABC. In your reasoning, please be sure to (a) quote the information (e.g., financial data and ratios, etc.) from the case to support your conclusion and (b) discuss what could have happened to ABC Corporation (e.g., business expansion, mergers and acquisitions, and competition, etc.).

EXHIBIT Al Financial Data and Selected Ratios for ABC: Fiscal Years 1996-1999 Based on 10K Data EXHIBIT Al (continue) * ABC fiscal year ends September 30th. 1. Revenues and Cost of Goods Sold excludes bulk shipment to customers' warehouse sites. The Company only serves as an intermediary and there is no material impact on the Company's operating earnings. 2. (a) Does not include pre-tax distributions on the Company's Preferred Securities. (b) Although the S\&P formulas call for "Gross Interest Expense" net interest is used because Gross Interest Expense was unavailable in the filings and could not be inferred. 3. Free operating cash flow = Funds from operations + Capital expenditure + Change in WC. Note for the above formula for free operating cash flow: (a) Capital expenditure is shown as a negative in the exhibit. That is why it is added to obtain free operating cash flow. (This is consistent with S\&P's formula for free operating cash flow as given in formula (4) in Exhibit A2.) (b) Increase in working capital for 1998 and 1999 is shown as a negative, so is added to free operating cash flow as per the S\&P formula (4) in Exhibit A2. EXHIBIT A2 S\&P's Formulas for Key Ratios 1. EBIT interest coverage =Grossinterestincurredbeforesubtracting(1)capitalizedinterestand(2)interestincomeEarningsfromcontinuingoperations"beforeinterestandtaxes 2. EBITDA interest coverage =Grossinterestincurredbeforesubtracting(1)capitalizedinterestand(2)interestincoEarningsfromcontinuingoperationsbeforeinterestandtaxes,depreciation,andamortization 3. Funds from operations/total debt =Long-termdebtpluscurrentmaturities,commercialpaper,andothershort-termborrowingsNetincomefromcontinuingoperationsplusdepreciation,amorization,deferredincometaxes,andothernoncashitems 4. Free operating cash flow/total debt =Longtermdebtpluscurrentmaturities,commercialpaper,andothershorFundsfromoperationsminuscapitalexpenditures,minus(plus)theincrease(decrease)inworkingcapital(excludingchangesincash) 6. Operating income/sales =SalesSalesminuscostofgoodsmanufaccured(beforedepreciationandamortization),selling,generalandadministrative,andresearchanddevelopmentcosts 7. Long-term debt/capitalization =long-termdebt+shareholdersequity(includingpreferredstock)plusminorityinterestLong-termdebt+ +shareholders' equity (including preferred stock) plus minority interest * Including amount for operating lease debt equivalent + Including interest income and equity earnings; excluding nonrecurring items. EXHIBIT Al Financial Data and Selected Ratios for ABC: Fiscal Years 1996-1999 Based on 10K Data EXHIBIT Al (continue) * ABC fiscal year ends September 30th. 1. Revenues and Cost of Goods Sold excludes bulk shipment to customers' warehouse sites. The Company only serves as an intermediary and there is no material impact on the Company's operating earnings. 2. (a) Does not include pre-tax distributions on the Company's Preferred Securities. (b) Although the S\&P formulas call for "Gross Interest Expense" net interest is used because Gross Interest Expense was unavailable in the filings and could not be inferred. 3. Free operating cash flow = Funds from operations + Capital expenditure + Change in WC. Note for the above formula for free operating cash flow: (a) Capital expenditure is shown as a negative in the exhibit. That is why it is added to obtain free operating cash flow. (This is consistent with S\&P's formula for free operating cash flow as given in formula (4) in Exhibit A2.) (b) Increase in working capital for 1998 and 1999 is shown as a negative, so is added to free operating cash flow as per the S\&P formula (4) in Exhibit A2. EXHIBIT A2 S\&P's Formulas for Key Ratios 1. EBIT interest coverage =Grossinterestincurredbeforesubtracting(1)capitalizedinterestand(2)interestincomeEarningsfromcontinuingoperations"beforeinterestandtaxes 2. EBITDA interest coverage =Grossinterestincurredbeforesubtracting(1)capitalizedinterestand(2)interestincoEarningsfromcontinuingoperationsbeforeinterestandtaxes,depreciation,andamortization 3. Funds from operations/total debt =Long-termdebtpluscurrentmaturities,commercialpaper,andothershort-termborrowingsNetincomefromcontinuingoperationsplusdepreciation,amorization,deferredincometaxes,andothernoncashitems 4. Free operating cash flow/total debt =Longtermdebtpluscurrentmaturities,commercialpaper,andothershorFundsfromoperationsminuscapitalexpenditures,minus(plus)theincrease(decrease)inworkingcapital(excludingchangesincash) 6. Operating income/sales =SalesSalesminuscostofgoodsmanufaccured(beforedepreciationandamortization),selling,generalandadministrative,andresearchanddevelopmentcosts 7. Long-term debt/capitalization =long-termdebt+shareholdersequity(includingpreferredstock)plusminorityinterestLong-termdebt+ +shareholders' equity (including preferred stock) plus minority interest * Including amount for operating lease debt equivalent + Including interest income and equity earnings; excluding nonrecurring items