Answered step by step

Verified Expert Solution

Question

1 Approved Answer

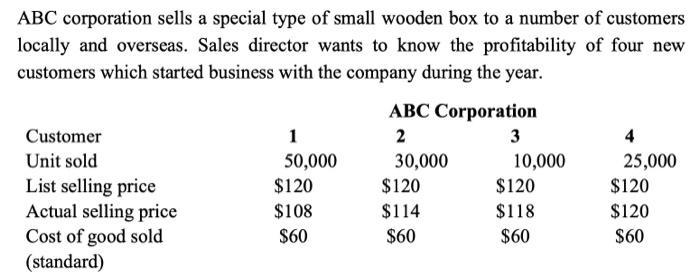

ABC corporation sells a special type of small wooden box to a number of customers locally and overseas. Sales director wants to know the

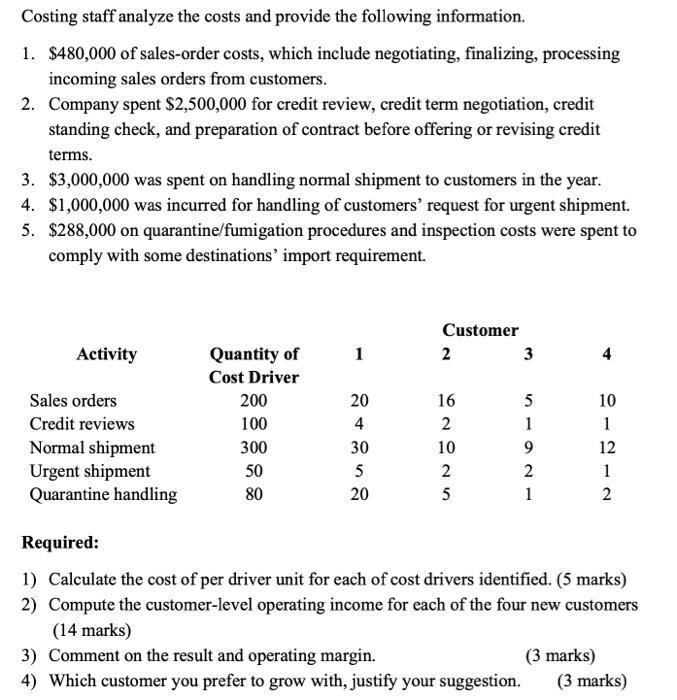

ABC corporation sells a special type of small wooden box to a number of customers locally and overseas. Sales director wants to know the profitability of four new customers which started business with the company during the year. ABC Corporation Customer 1 2 3 4 Unit sold 50,000 $120 30,000 10,000 25,000 List selling price Actual selling price Cost of good sold (standard) $120 $120 $120 $108 $114 $118 $120 $60 $60 $60 $60 Costing staff analyze the costs and provide the following information. 1. $480,000 of sales-order costs, which include negotiating, finalizing, processing incoming sales orders from customers. 2. Company spent $2,500,000 for credit review, credit term negotiation, credit standing check, and preparation of contract before offering or revising credit terms. 3. $3,000,000 was spent on handling normal shipment to customers in the year. 4. $1,000,000 was incurred for handling of customers' request for urgent shipment. 5. $288,000 on quarantine/fumigation procedures and inspection costs were spent to comply with some destinations' import requirement. Customer Activity Quantity of 1 3 Cost Driver Sales orders 200 20 16 10 Credit reviews 100 4 1 1 Normal shipment Urgent shipment Quarantine handling 300 30 10 12 50 5 2 1 80 20 5 1 Required: 1) Calculate the cost of per driver unit for each of cost drivers identified. (5 marks) 2) Compute the customer-level operating income for each of the four new customers (14 marks) 3) Comment on the result and operating margin. (3 marks) 4) Which customer you prefer to grow with, justify your suggestion. (3 marks) 4. 2)

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the Cost of per driver unit for each of cost drivers Allocation of cost to each customer C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started