Answered step by step

Verified Expert Solution

Question

1 Approved Answer

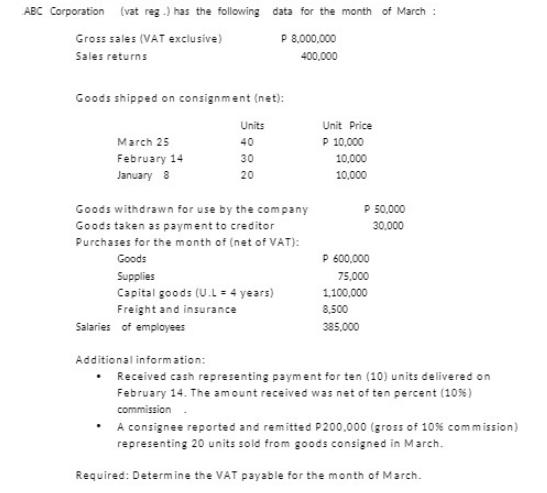

ABC Corporation (vat reg.) has the following Gross sales (VAT exclusive) Sales returns Goods shipped on consignment (net): March 25 February 14 January 8

ABC Corporation (vat reg.) has the following Gross sales (VAT exclusive) Sales returns Goods shipped on consignment (net): March 25 February 14 January 8 Salaries of employees data for the month of March : P 8,000,000 400,000 Units 40 30 20 Goods withdrawn for use by the company Goods taken as payment to creditor Purchases for the month of (net of VAT): Goods Supplies Capital goods (U.L = 4 years) Freight and insurance . Unit Price P 10,000 10,000 10,000 P 50,000 30,000 P 600,000 75,000 1,100,000 8,500 385,000 Additional information: Received cash representing payment for ten (10) units delivered on February 14. The amount received was net of ten percent (10%) commission A consignee reported and remitted P200,000 (gross of 10% commission) representing 20 units sold from goods consigned in March. Required: Determine the VAT payable for the month of March.

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To determine the VAT payable for the month of March we need to calculate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started