Answered step by step

Verified Expert Solution

Question

1 Approved Answer

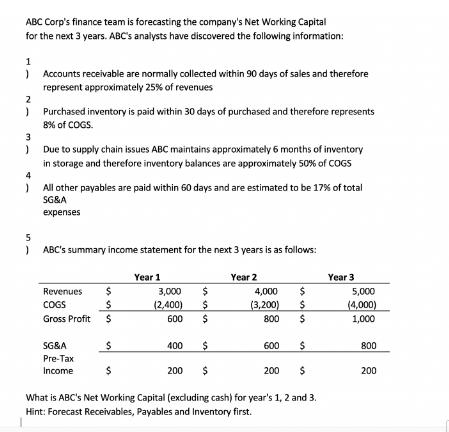

ABC Corp's finance team is forecasting the company's Net Working Capital for the next 3 years. ABC's analysts have discovered the following information: 1

ABC Corp's finance team is forecasting the company's Net Working Capital for the next 3 years. ABC's analysts have discovered the following information: 1 ) Accounts receivable are normally collected within 90 days of sales and therefore 2 represent approximately 25% of revenues ) Purchased inventory is paid within 30 days of purchased and therefore represents 8% of COGS. 3 ) Due to supply chain issues ABC maintains approximately 6 months of inventory 4 in storage and therefore inventory balances are approximately 50% of COGS ) All other payables are paid within 60 days and are estimated to be 17% of total 5 SG&A expenses ) ABC's summary income statement for the next 3 years is as follows: Year 1 Year 2 Year 3 Revenues $ COGS $ 3,000 (2,400) Gross Profit $ 600 ssssss $ 4,000 $ 5,000 $ (3,200) $ (4,000) $ 800 $ 1,000 SG&A $ 400 $ 600 $ 800 Pre-Tax Income $ 200 $ 200 $ 200 What is ABC's Net Working Capital (excluding cash) for year's 1, 2 and 3. Hint: Forecast Receivables, Payables and Inventory first.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started