Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC costing system will not include the direct materials and direct labors because both were directly traced to each product as shown in previous

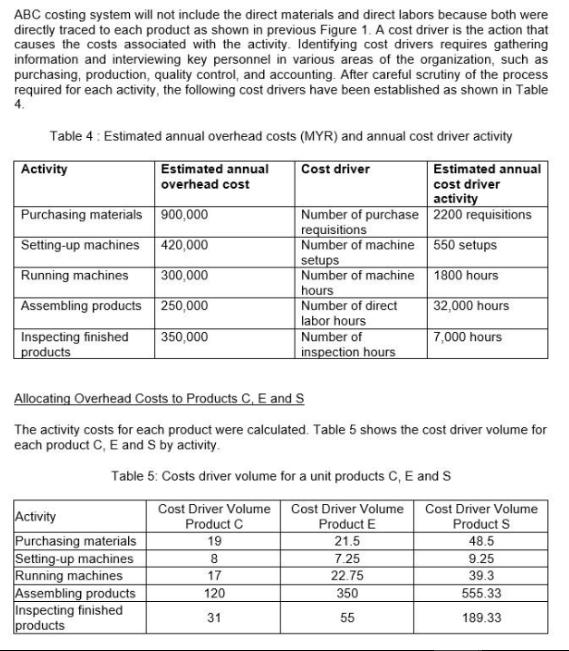

ABC costing system will not include the direct materials and direct labors because both were directly traced to each product as shown in previous Figure 1. A cost driver is the action that causes the costs associated with the activity. Identifying cost drivers requires gathering information and interviewing key personnel in various areas of the organization, such as purchasing, production, quality control, and accounting. After careful scrutiny of the process required for each activity, the following cost drivers have been established as shown in Table Table 4: Estimated annual overhead costs (MYR) and annual cost driver activity Cost driver Activity Purchasing materials 900,000 Setting-up machines 420,000 Running machines 300,000 Assembling products 250,000 Inspecting finished 350,000 products Estimated annual overhead cost Activity Purchasing materials Setting-up machines Running machines Assembling products Inspecting finished products Number of purchase requisitions Number of machine setups Number of machine hours Number of direct labor hours Allocating Overhead Costs to Products C, E and S The activity costs for each product were calculated. Table 5 shows the cost driver volume for each product C, E and S by activity. Table 5: Costs driver volume for a unit products C, E and S Cost Driver Volume Product C 19 8 17 120 31 Number of inspection hours Cost Driver Volume Product E 21.5 Estimated annual cost driver activity 2200 requisitions 550 setups 1800 hours 32,000 hours 7,000 hours 7.25 22.75 350 55 Cost Driver Volume Product S 48.5 9.25 39.3 555.33 189.33 Prepare ABC template that shows: Calculation of rate for each cost driver and assign those cost to the range of products. (ii) Illustrates how the activity costs were allocated to three different product C,E and S. Discuss how the highest cost driver rate (that is, purchasing materials, setting up machine) can be reduced to improve profitability of each product. (iv) Analyse the cost structure of Product C,E and S. (v) (i) Show the comparison of cost between ABC and traditional costing system and percentage of variation in manufacturing cost for each product. (vi) Highlights the differences in accuracy and complexity of these 2 methods derive from earlier calculations. (vii) Provide conclusion from the analysis conducted between traditional costing system and ABC system with suggestion for effective costing method between that two.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i Calculation of Rate for Each Cost Driver and Assignment to Products C E and S To calculate the rate for each cost driver we will divide the estimated annual overhead cost by the estimated annual cos...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started