Answered step by step

Verified Expert Solution

Question

1 Approved Answer

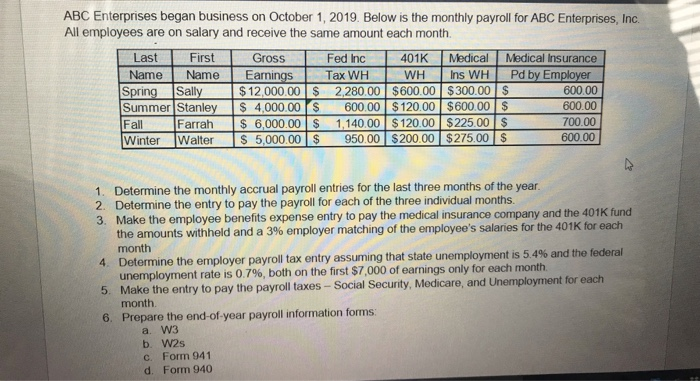

ABC Enterprises began business on October 1, 2019. Below is the monthly payroll for ABC Enterprises, Inc. All employees are on salary and receive

ABC Enterprises began business on October 1, 2019. Below is the monthly payroll for ABC Enterprises, Inc. All employees are on salary and receive the same amount each month. Last First Name Name Spring Sally Summer Stanley Fall Farrah Winter Walter Medical Medical Insurance 401K WH Ins WH Pd by Employer $600.00 $300.00 $ 600.00 $120.00 $600.00 $ 1,140.00 $120.00 $225.00 $ 950.00 $200.00 $275.00 $ Gross Fed Inc Earnings Tax WH $12,000.00 $ 2,280.00 $ 4,000.00 $ $6,000.00 $ $ 5,000.00 $ C. Form 941 d. Form 940 1. Determine the monthly accrual payroll entries for the last three months of the year. 2. Determine the entry to pay the payroll for each of the three individual months. 3. Make the employee benefits expense entry to pay the medical insurance company and the 401K fund the amounts withheld and a 3% employer matching of the employee's salaries for the 401K for each month 4. Determine the employer payroll tax entry assuming that state unemployment is 5.4% and the federal unemployment rate is 0.7%, both on the first $7,000 of earnings only for each month. 5. Make the entry to pay the payroll taxes - Social Security, Medicare, and Unemployment for each month. 6. Prepare the end-of-year payroll information forms: a. W3 b. W2s 600.00 600.00 700.00 600.00

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1 2 Particulars Debit Credit Salaries expense 24500 Medical Insuranc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started