Question

ABC Framing has been hired to frame a light commercial building. The project began on July 2 and was completed on August 9. The following

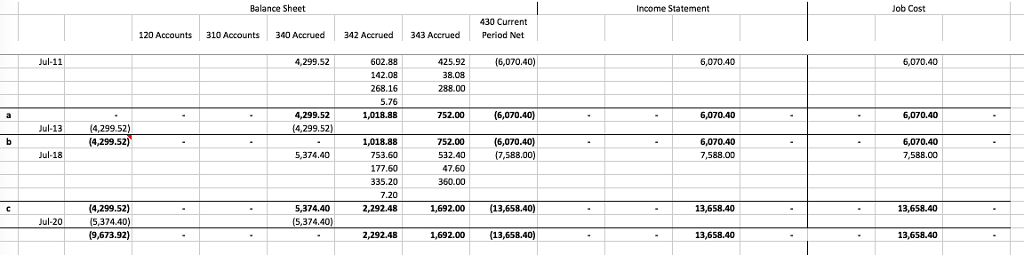

ABC Framing has been hired to frame a light commercial building. The project began on July 2 and was completed on August 9. The following is a list of accounting transactions associated with the project. For each transaction, determine the changes that occur on the balance sheet, income statement, and job cost ledger as a result of the transaction and the year-to-date totals by general ledger account and job cost code. The company uses the chart of accounting in Figure 2-1. The general contractor doesnt withhold retention.

All costs are billed to job cost code 1005.06110. The appropriate cost type (M, L, or E) needs to be added to the job cost code. The company rents its equipment and the equipment is billed directly to the job cost ledger; therefore, they do not keep an equipment ledger.

(an example excel sheet is posted at the bottom)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started