Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Company had the following beginning balances: Raw materials, $1,000. Work in process inventory, $4,000 Finished goods inventory, $6,000 Accounts payable, $500. During the

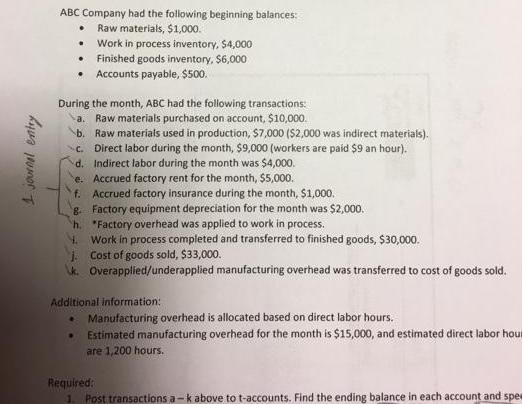

ABC Company had the following beginning balances: Raw materials, $1,000. Work in process inventory, $4,000 Finished goods inventory, $6,000 Accounts payable, $500. During the month, ABC had the following transactions: a. Raw materials purchased on account, $10,000. b. Raw materials used in production, $7,000 (S2,000 was indirect materials). c. Direct labor during the month, $9,000 (workers are paid $9 an hour). d. Indirect labor during the month was $4,000. e. Accrued factory rent for the month, $5,000. f. Accrued factory insurance during the month, $1,000. g. Factory equipment depreciation for the month was $2,000. h. "Factory overhead was applied to work in process. Work in process completed and transferred to finished goods, $30,000. i Cost of goods sold, $33,000. Overapplied/underapplied manufacturing overhead was transferred to cost of goods sold. Additional information: Manufacturing overhead is allocated based on direct labor hours. Estimated manufacturing overhead for the month is $15,000, and estimated direct labor hou are 1,200 hours. Required: 1. Post transactions a-k above to t-accounts. Find the ending balance in each account and spei L journal entry

Step by Step Solution

★★★★★

3.58 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Raw materials balance sheet assets Work in Process Bal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started