Question

ABC Inc. is a Canadian controlled private corporation. The Company began operations on January 1, 1998 and uses a taxation year that ends on December

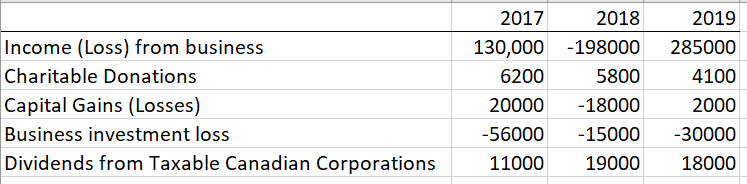

ABC Inc. is a Canadian controlled private corporation. The Company began operations on January 1, 1998 and uses a taxation year that ends on December 31. The following data summarize the operations for the years from 2017 to 2019.

The company has a net capital loss balance of $10,000 which arose in 1999. It is the policy of the Company to deduct charitable donations prior to any loss carry overs. It also has a policy of minimizing net-capital loss carryovers, as opposed to non-capital loss carryovers.

Required:

1. Compute the taxable income for the years indicated according to the ordering rules in section 3 and show the amounts that would be available at the end of the year. Organize your answers line-by-line across years, rather than one year at a time.

2. Compute Part I federal tax payable for 2019. Assume that the company has $50,000 income subject to small business deduction and

3. 65% of taxable income attributed to the U.S.

4. Show all calculations whether they are necessary to the final answer.

2019 Income (Loss) from business Charitable Donations Capital Gains (Losses) Business investment loss Dividends from Taxable Canadian Corporations 2017 2018 130,000 -198000 6200 5800 20000 -18000 -56000 -15000 11000 19000 285000 4100 2000 -30000 . 18000 2019 Income (Loss) from business Charitable Donations Capital Gains (Losses) Business investment loss Dividends from Taxable Canadian Corporations 2017 2018 130,000 -198000 6200 5800 20000 -18000 -56000 -15000 11000 19000 285000 4100 2000 -30000 . 18000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started