Answered step by step

Verified Expert Solution

Question

1 Approved Answer

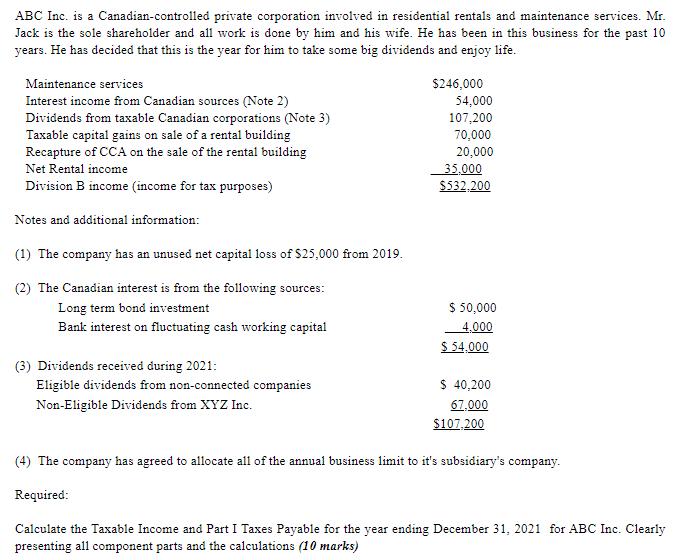

ABC Inc. is a Canadian-controlled private corporation involved in residential rentals and maintenance services. Mr. Jack is the sole shareholder and all work is

ABC Inc. is a Canadian-controlled private corporation involved in residential rentals and maintenance services. Mr. Jack is the sole shareholder and all work is done by him and his wife. He has been in this business for the past 10 years. He has decided that this is the year for him to take some big dividends and enjoy life. Maintenance services Interest income from Canadian sources (Note 2) Dividends from taxable Canadian corporations (Note 3) Taxable capital gains on sale of a rental building Recapture of CCA on the sale of the rental building Net Rental income Division B income (income for tax purposes) Notes and additional information: (1) The company has an unused net capital loss of $25,000 from 2019. (2) The Canadian interest is from the following sources: Long term bond investment Bank interest on fluctuating cash working capital (3) Dividends received during 2021: Eligible dividends from non-connected companies Non-Eligible Dividends from XYZ Inc. $246,000 54,000 107,200 70,000 20,000 35,000 $532,200 $ 50,000 4,000 $ 54,000 $ 40,200 67,000 $107,200 (4) The company has agreed to allocate all of the annual business limit to it's subsidiary's company. Required: Calculate the Taxable Income and Part I Taxes Payable for the year ending December 31, 2021 for ABC Inc. Clearly presenting all component parts and the calculations (10 marks)

Step by Step Solution

★★★★★

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

32 Sol Ans a ins h Kins rcx h 015 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started