Answered step by step

Verified Expert Solution

Question

1 Approved Answer

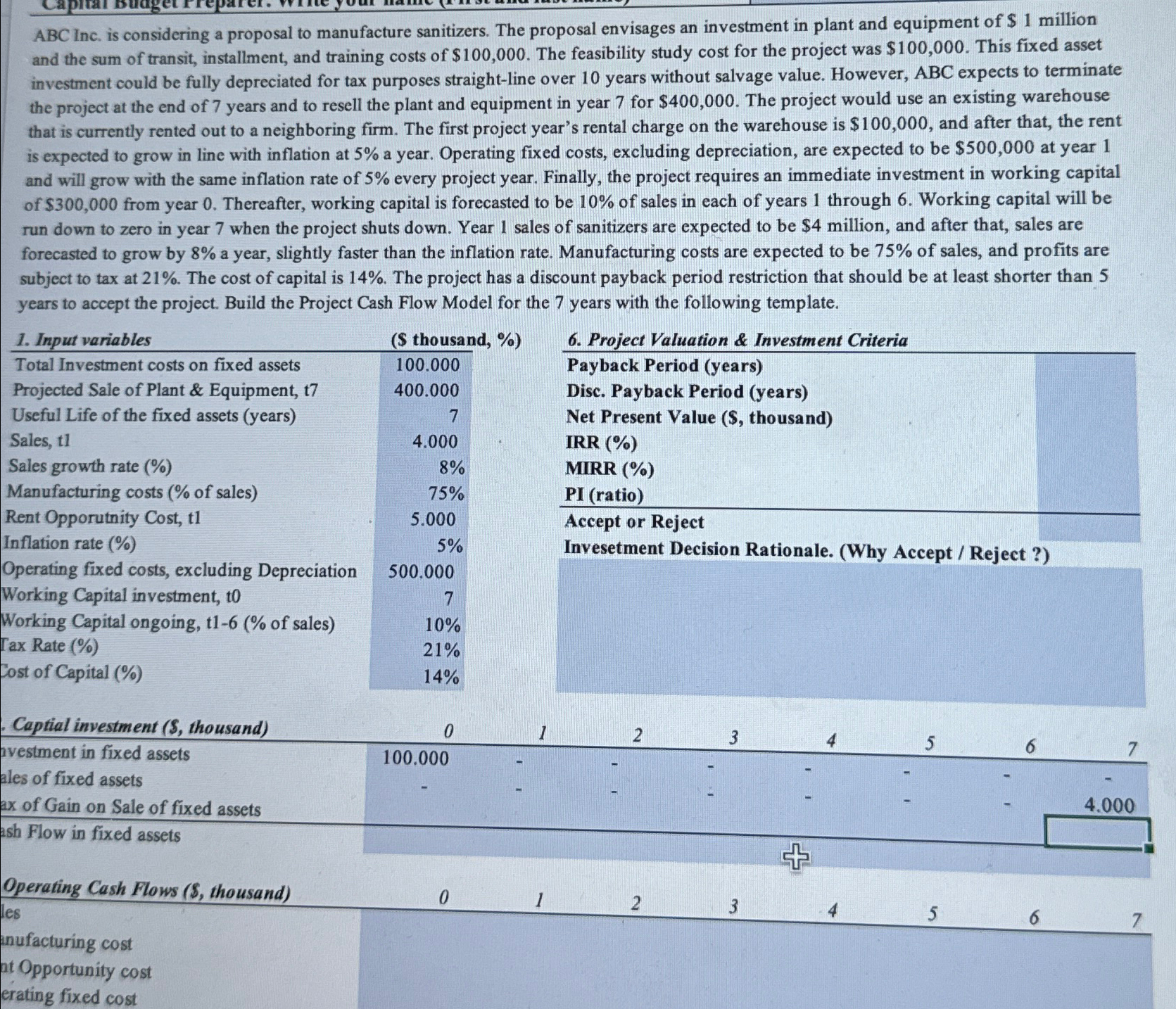

ABC Inc. is considering a proposal to manufacture sanitizers. The proposal envisages an investment in plant and equipment of $ 1 million and the sum

ABC Inc. is considering a proposal to manufacture sanitizers. The proposal envisages an investment in plant and equipment of $ million and the sum of transit, installment, and training costs of $ The feasibility study cost for the project was $ This fixed asset investment could be fully depreciated for tax purposes straightline over years without salvage value. However, ABC expects to terminate the project at the end of years and to resell the plant and equipment in year for $ The project would use an existing warehouse that is currently rented out to a neighboring firm. The first project year's rental charge on the warehouse is $ and after that, the rent is expected to grow in line with inflation at a year. Operating fixed costs, excluding depreciation, are expected to be $ at year and will grow with the same inflation rate of every project year. Finally, the project requires an immediate investment in working capital of $ from year Thereafter, working capital is forecasted to be of sales in each of years through Working capital will be run down to zero in year when the project shuts down. Year sales of sanitizers are expected to be $ million, and after that, sales are forecasted to grow by a year, slightly faster than the inflation rate. Manufacturing costs are expected to be of sales, and profits are subject to tax at The cost of capital is The project has a discount payback period restriction that should be at least shorter than years to accept the project. Build the Project Cash Flow Model for the years with the following template.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started