Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Inc. is considering the purchase of a street paver machine for $225,000. The expected life of the machine will be three years, and

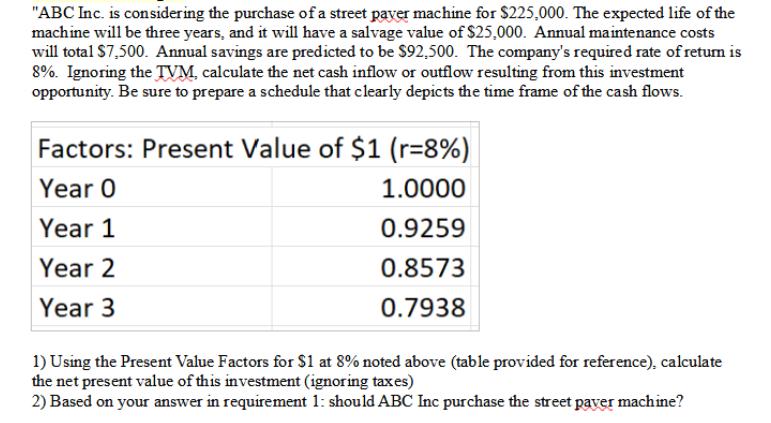

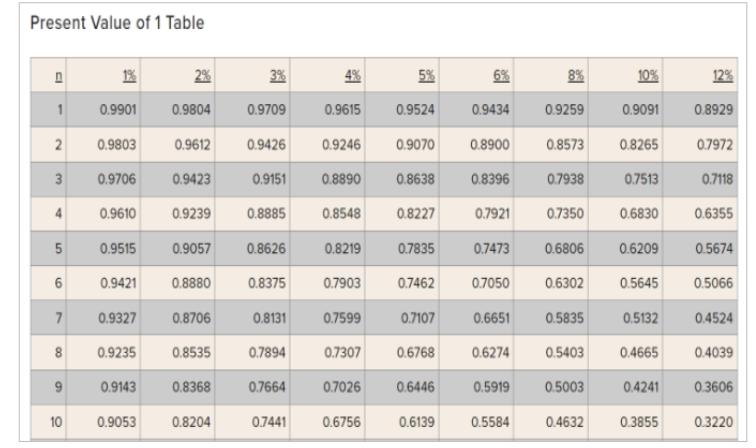

"ABC Inc. is considering the purchase of a street paver machine for $225,000. The expected life of the machine will be three years, and it will have a salvage value of $25,000. Annual maintenance costs will total $7,500. Annual savings are predicted to be $92,500. The company's required rate of return is 8%. Ignoring the TVM, calculate the net cash inflow or outflow resulting from this investment opportunity. Be sure to prepare a schedule that clearly depicts the time frame of the cash flows. Factors: Present Value of $1 (r=8%) Year 0 Year 1 Year 2 Year 3 1.0000 0.9259 0.8573 0.7938 1) Using the Present Value Factors for $1 at 8% noted above (table provided for reference), calculate the net present value of this investment (ignoring taxes) 2) Based on your answer in requirement 1: should ABC Inc purchase the street paver machine? Present Value of 1 Table 5% 6% 10% 12% 1 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9259 0.9091 0.8929 2 0.9803 0.9612 0.9426 0.9246 0.9070 0.8900 0.8573 0.8265 0.7972 3 0.9706 0.9423 0.9151 0.8890 0.8638 0.8396 0.7938 0.7513 0.7118 4 0.9610 0.9239 0.8885 0.8548 0.8227 0.7921 0.7350 0.6830 0.6355 5 0.9515 0.9057 0.8626 0.8219 0.7835 0.7473 0.6806 0.6209 0.5674 6 0.9421 0.8880 0.8375 0.7903 0.7462 0.7050 0.6302 0.5645 0.5066 7 0.9327 0.8706 0.8131 0.7599 0.7107 0.6651 0.5835 0.5132 0.4524 8 0.9235 0.8535 0.7894 0.7307 0.6768 0.6274 0.5403 0.4665 0.4039 6 0.9143 0.8368 0.7664 0.7026 0.6446 0.5919 0.5003 0.4241 0.3606 10 0.9053 0.8204 0.7441 0.6756 0.6139 0.5584 0.4632 0.3855 0.3220

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started