Answered step by step

Verified Expert Solution

Question

1 Approved Answer

( ABC ) Inc. preparing their annual budget for 2 0 2 3 financial period. The following data were available concerning this period: The monthly

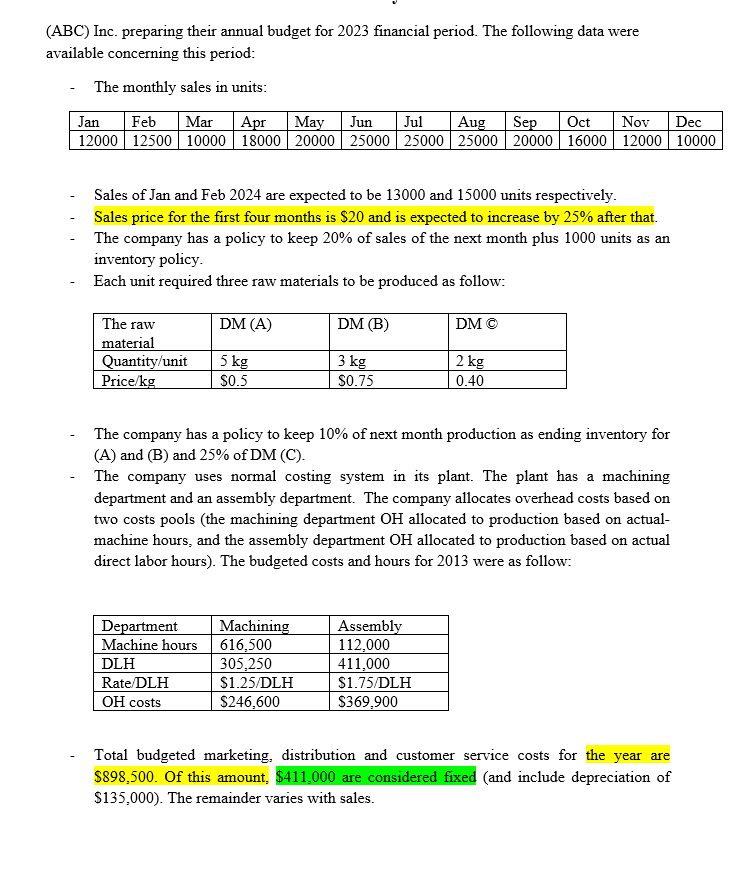

ABC Inc. preparing their annual budget for financial period. The following data were

available concerning this period:

The monthly sales in units:

Sales of Jan and Feb are expected to be and units respectively.

Sales price for the first four months is $ and is expected to increase by after that.

The company has a policy to keep of sales of the next month plus units as an

inventory policy.

Each unit required three raw materials to be produced as follow:

The company has a policy to keep of next month production as ending inventory for

A and B and of DM C

The company uses normal costing system in its plant. The plant has a machining

department and an assembly department. The company allocates overhead costs based on

two costs pools the machining department OH allocated to production based on actual

machine hours, and the assembly department OH allocated to production based on actual

direct labor hours The budgeted costs and hours for were as follow:

Total budgeted marketing, distribution and customer service costs for the year are

$ Of this amount, $ are considered fixed and include depreciation of

$ The remainder varies with sales. The budgeted general and administrative costs includes the following monthly costs all

are fixed:

The budgeted capitalized expenditures and revenues are as follow:

Paying to bonds payable an amount of $ plus $ as bonds interest during

March

Purchasing equipment at a budgeted amount of $ and sell the old equipment

at a budgeted amount of $ The purchase is expected to take place in June and

selling the old equipment is expected to be in August.

There are rent revenues at an amount of $ semiannually, collected in July and

January of each year.

Cash from sales revenues are collected as follow: in the month of sales, in the

month next of the month of sale, in the month after, and the last are uncollectible.

Payment to DM A and B are as follow: in the month of sale and in the month

next to the month of sale. Payment to is in the same month of sale ie all DM

C purchases are in cash

Sales of Nov and Dec were units and units and the sales price was $

per unit.

Accounts payable in of Dec was $

All other expenses are paid as incurred.

Cash beginning balance was $

In case of deficit, the company will borrow the shortage from the bank at annual

interest rate.

In case of surplus, the company will invest the extra cash in short term investment at a

annual return.

The company will not borrow unless they sold their investment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started