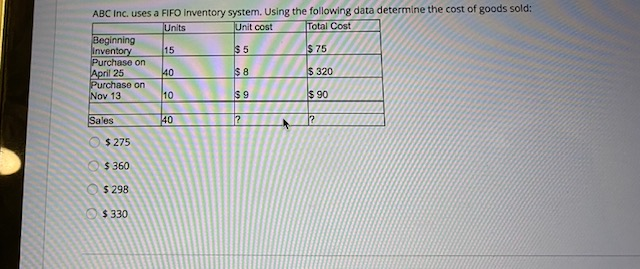

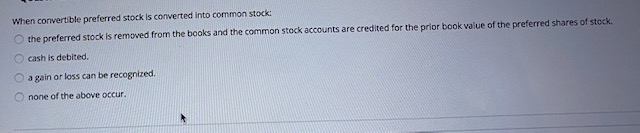

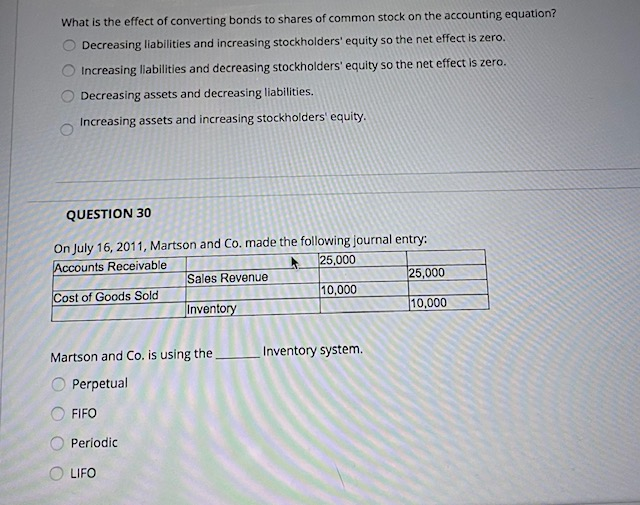

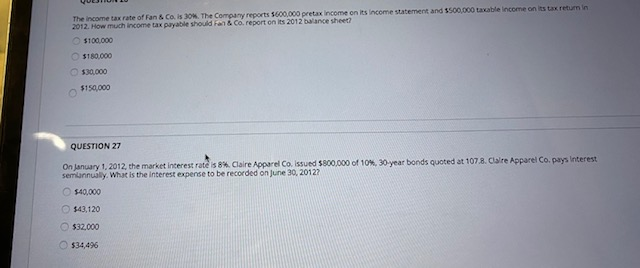

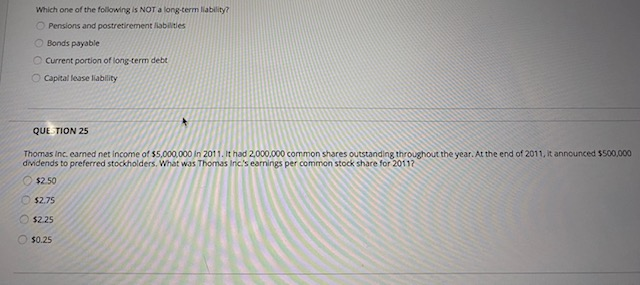

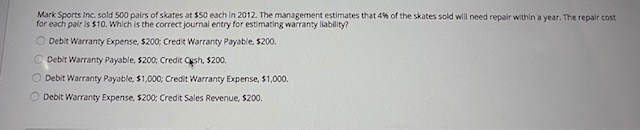

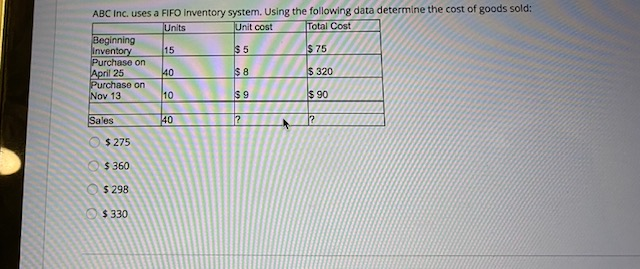

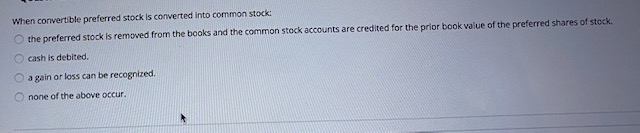

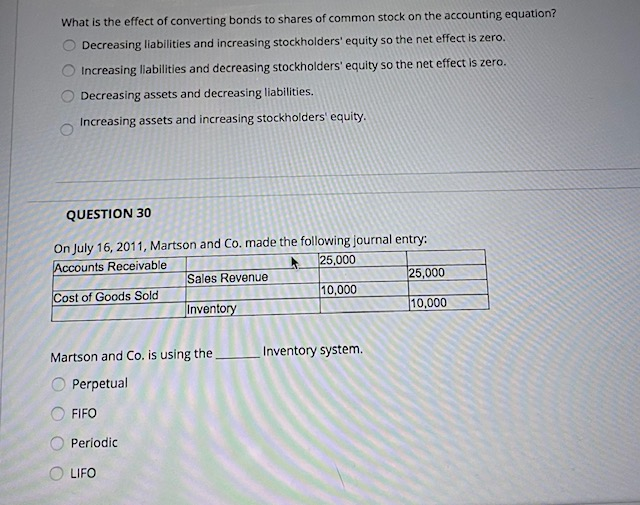

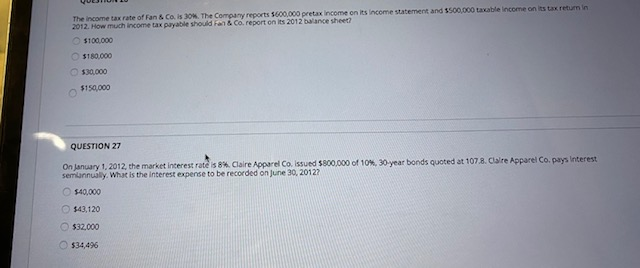

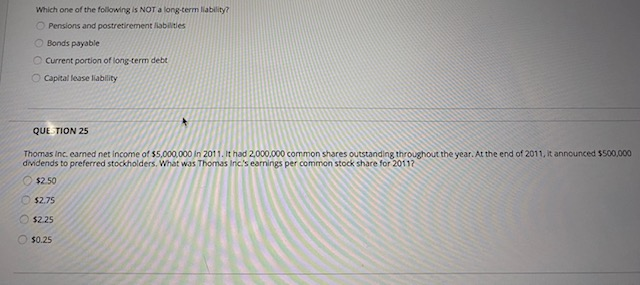

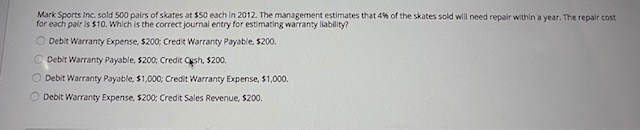

ABC Inc. uses a FIFO Inventory system. Using the following data determine the cost of goods sold: Units Unit cost Total Cost Beginning inventory 15 $ 5 $ 75 Purchase on April 25 140 $ 8 $ 320 Purchase on Nov 13 10 $ 9 $ 90 Sales 40 ? 12 $ 275 O$ 360 $ 298 $ 330 When convertible preferred stock is converted into common stock: the preferred stock is removed from the books and the common stock accounts are credited for the prior book value of the preferred shares of stock. cash is debited. a gain or loss can be recognized none of the above occur. What is the effect of converting bonds to shares of common stock on the accounting equation? Decreasing liabilities and increasing stockholders' equity so the net effect is zero. Increasing liabilities and decreasing stockholders' equity so the net effect is zero. Decreasing assets and decreasing liabilities, Increasing assets and increasing stockholders' equity. QUESTION 30 On July 16, 2011, Martson and Co. made the following journal entry: Accounts Receivable 25,000 Sales Revenue 25,000 Cost of Goods Sold 10,000 Inventory 10,000 Inventory system. Martson and Co. is using the Perpetual FIFO Periodic OLIFO The income tax rate of Fan & Co. is 30. The Company reports $600,000 pretax income on its income statement and $500,000 taxable income on its tax retum in 2012. How much income tax payable should fan&Co. report on its 2012 balance sheet $100,000 $180,000 $30,000 $150,000 QUESTION 27 On January 1, 2012, the market interest rate is 8 Claire Apparel Co. Issued 5800,000 of 10%, 30 year bonds quoted at 107.8. Clare Apparel Co. pays Interest semiannually. What is the interest expense to be recorded on June 30, 2012 $40,000 $43.120 $32,000 534496 Which one of the following is NOT a long-term liability? Pensions and postretirement liabilities Bonds payable Current portion of long term debt Capital lease ability QUE TION 25 Thomas Inc. earned net income of $5,000,000 in 2011. It had 2,000,000 common shares outstanding throughout the year. At the end of 2011, it announced $500,000 dividends to preferred stockholders. What was Thomas Inic's earnings per common stock share for 20112 $2.50 $2.75 52 25 $0.25 Mark Sports Inc. sold 500 pairs of skates at $50 each in 2012. The management estimates that 4% of the skates sold will need repair within a year. The repair cost for each pair is 510. Which is the correct journal entry for estimating warranty liability? Debit Warranty Expense, $200: Crear Warranty Payable $200. Debit Warranty Payable, 5200; Creditsh, $200. Debit Warranty Payable, $1,000; Credit Warranty Expense, $1,000. Debit Warranty Expense, 5200: Credit Sales Revenue, $200