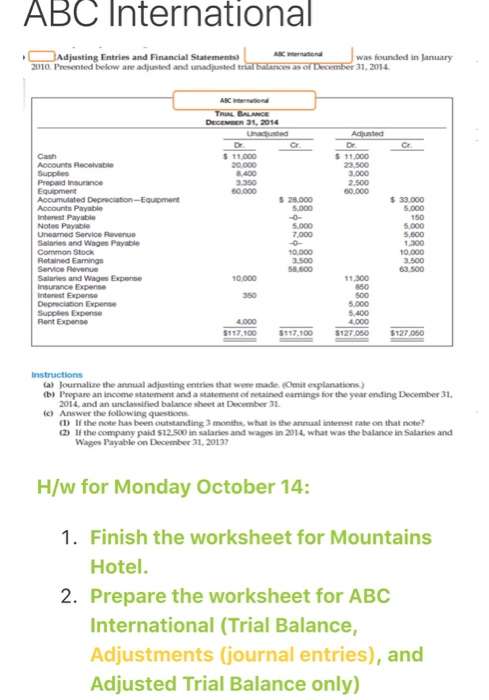

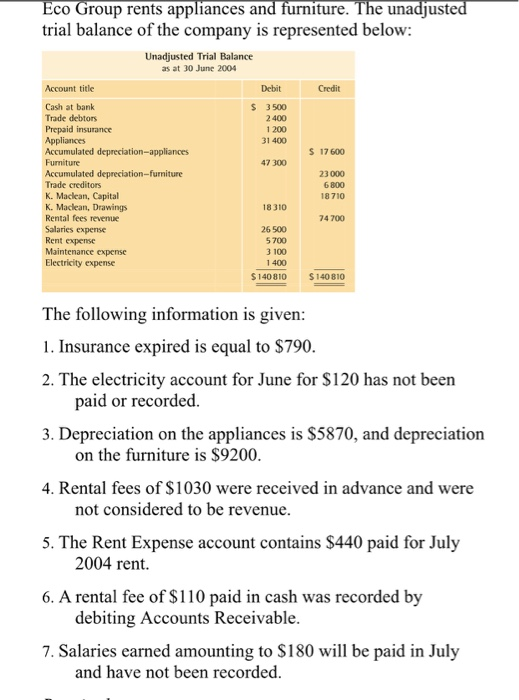

ABC International Adiustine Entries and Financial Statements) A r tion was founded in Lanuary 2010. Presented below are adjusted and unadjusted trial balances as of December 31, 2014 ABC DECEMBER 31, 2014 Uradjusted Adjusted Cr. Accounts Receivable $11.000 20 000 8.400 3.350 50.000 $ 11,000 23.500 3,000 2.500 00.000 $ 33.000 $28.000 5.000 5.000 7.000 Prepaid Insurance Equipment Accumulated Depreciation Equipment Accounts Payable Interest Payable Notes Payable Uneared Service Revenue Salaries and Wages Payable Common Stock Retained Earnings Service Revenue Salaries and Wages Expense Insurance Expense Interest Expense Depreciation Expense Supplies Expense Rent Expense 10.000 3.500 5,600 1.300 10.000 3.500 63.500 S8600 11 100 10,000 350 5.400 4.000 $137.100 $127.060 instructions (a) Journalize the annual adjusting entries that were made Omit explanations) (b) Prepare an income statement and a statement of retained earnings for the year ending December 31, 2014, and an unclassified balance sheet at December 31 (c) Answer the following questions (1) If the note has been outstanding 3 months, what is the annual interest rate on that note? (2) If the company paid $12.500 in salaries and wages in 2014. what was the balance in Salaries and Wages Payable on December 31, 2013? H/w for Monday October 14: 1. Finish the worksheet for Mountains Hotel 2. Prepare the worksheet for ABC International (Trial Balance, Adjustments (journal entries), and Adjusted Trial Balance only) Eco Group rents appliances and furniture. The unadjusted trial balance of the company is represented below: Unadjusted Trial Balance as at 30 June 2004 Account title Debit Credit $ 3500 2 400 1 200 31 400 17600 47300 23 000 Cash at bank Trade debtors Prepaid insurance Appliances Accumulated depreciation-appliances Furniture Accumulated depreciation-furniture Trade creditors K. Maclean, Capital K. Maclean, Drawings Rental fees revenue Salaries expense Rent expense Maintenance expense Electricity expense 6800 18710 18 310 74 700 26 500 5700 3 100 1 400 $140810 $140810 The following information is given: 1. Insurance expired is equal to $790. 2. The electricity account for June for $120 has not been paid or recorded. 3. Depreciation on the appliances is $5870, and depreciation on the furniture is $9200. 4. Rental fees of $1030 were received in advance and were not considered to be revenue. 5. The Rent Expense account contains $440 paid for July 2004 rent. 6. A rental fee of $110 paid in cash was recorded by debiting Accounts Receivable. 7. Salaries earned amounting to $180 will be paid in July and have not been recorded. ABC International Adiustine Entries and Financial Statements) A r tion was founded in Lanuary 2010. Presented below are adjusted and unadjusted trial balances as of December 31, 2014 ABC DECEMBER 31, 2014 Uradjusted Adjusted Cr. Accounts Receivable $11.000 20 000 8.400 3.350 50.000 $ 11,000 23.500 3,000 2.500 00.000 $ 33.000 $28.000 5.000 5.000 7.000 Prepaid Insurance Equipment Accumulated Depreciation Equipment Accounts Payable Interest Payable Notes Payable Uneared Service Revenue Salaries and Wages Payable Common Stock Retained Earnings Service Revenue Salaries and Wages Expense Insurance Expense Interest Expense Depreciation Expense Supplies Expense Rent Expense 10.000 3.500 5,600 1.300 10.000 3.500 63.500 S8600 11 100 10,000 350 5.400 4.000 $137.100 $127.060 instructions (a) Journalize the annual adjusting entries that were made Omit explanations) (b) Prepare an income statement and a statement of retained earnings for the year ending December 31, 2014, and an unclassified balance sheet at December 31 (c) Answer the following questions (1) If the note has been outstanding 3 months, what is the annual interest rate on that note? (2) If the company paid $12.500 in salaries and wages in 2014. what was the balance in Salaries and Wages Payable on December 31, 2013? H/w for Monday October 14: 1. Finish the worksheet for Mountains Hotel 2. Prepare the worksheet for ABC International (Trial Balance, Adjustments (journal entries), and Adjusted Trial Balance only) Eco Group rents appliances and furniture. The unadjusted trial balance of the company is represented below: Unadjusted Trial Balance as at 30 June 2004 Account title Debit Credit $ 3500 2 400 1 200 31 400 17600 47300 23 000 Cash at bank Trade debtors Prepaid insurance Appliances Accumulated depreciation-appliances Furniture Accumulated depreciation-furniture Trade creditors K. Maclean, Capital K. Maclean, Drawings Rental fees revenue Salaries expense Rent expense Maintenance expense Electricity expense 6800 18710 18 310 74 700 26 500 5700 3 100 1 400 $140810 $140810 The following information is given: 1. Insurance expired is equal to $790. 2. The electricity account for June for $120 has not been paid or recorded. 3. Depreciation on the appliances is $5870, and depreciation on the furniture is $9200. 4. Rental fees of $1030 were received in advance and were not considered to be revenue. 5. The Rent Expense account contains $440 paid for July 2004 rent. 6. A rental fee of $110 paid in cash was recorded by debiting Accounts Receivable. 7. Salaries earned amounting to $180 will be paid in July and have not been recorded