Question

ABC is a new client of your firm, CPA, ABC is owned equally by Wendy and her younger brother, Reggie. Their respective shareholdingsare set out

ABC is a new client of your firm, CPA, ABC is owned equally by Wendy and her younger brother, Reggie. Their respective shareholdingsare set out in Exhibit I. You have been supplied with the following information:- Wendy and Reggie do not agree on the direction that ABC should be taking to position itfor the future. As a result, Reggie has offered to buy out his sister's interest in ABC(Exhibit II).- The net assets of ABC have recently been appraised as a value of $2 million by aprofessional valuator. Wendy and Reggie have both agreed to accept this value.- Wendy currently lives in a house owned by ABC. As part of the buyout, she is to receivethis property from the corporation. The value of the house was appraised at $175,000 the professional Reggie does not have the funds to finance the acquisition of the shares personally and is,therefore, proposing a repurchase of the shares by ABC.

- Another alternative available to Reggie is to set up a holding company to purchase theshares from Wendy. He believes that Wendy will be able to utilize her capital gains

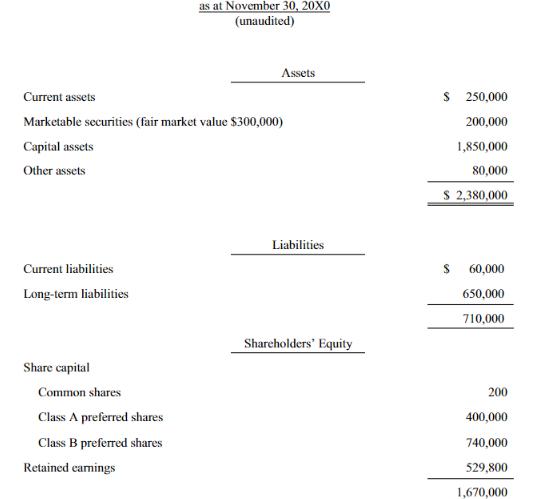

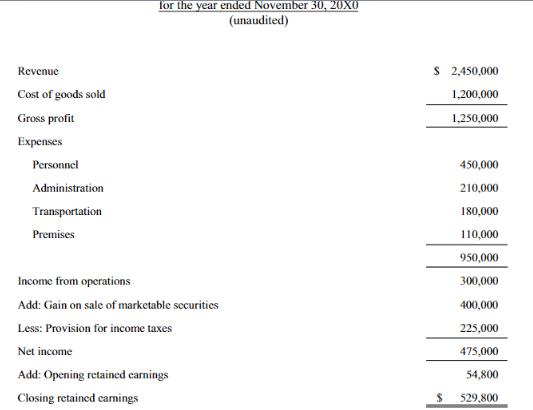

exemption and that he will be able to fund the purchase with dividends paid by ABC tothe holding company.Wendy and Reggie have asked your firm to review the draft agreement of purchase and sale andto discuss the detailed tax consequences. In addition, they would like your firm to recommendany changes to the proposed agreement that would minimize the overall tax cost. To assist yourfirm in this review, you have been provided with the enclosed extracts from ABC's financialstatements (Exhibit III).

Required:

draft report.

EXHIBIT ICORPORATE SHAREHOLDINGS

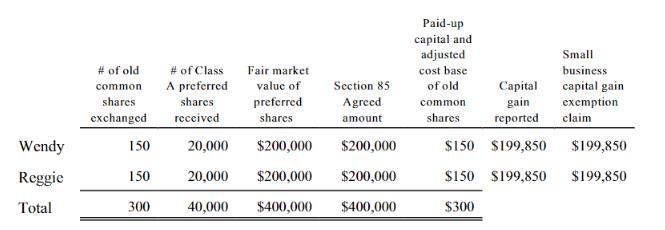

Four years ago, on December 31, 19X7, both Wendy and Reggie exchanged their old commonshares held in ABC for 20,000 Class A preferred voting shares. In addition, they each subscribedfor, and paid $100, for 100 new common shares. Accordingly, each shareholder accomplishedthe following:

The paid-up capital of the preferred shares is, in total, $300.Also, Wendy and Reggie each own 37,000 Class B preferred non-voting shares which werereceived as a result of the death of their father in 19X7. These shares were received from theirfather's estate at their total fair market value of $740,000. The estate claimed the maximum

The paid-up capital of the preferred shares is, in total, $300.Also, Wendy and Reggie each own 37,000 Class B preferred non-voting shares which werereceived as a result of the death of their father in 19X7. These shares were received from theirfather's estate at their total fair market value of $740,000. The estate claimed the maximum

capital gain exemption on the final return of their father. The paid-up capital on these shares isnominal.

XHIBIT II

EXCERPT FROM DRAFT AGREEMENT OF PURCHASE AND SALEIn full consideration of the purchase and sale, the parties hereby agree as follows:

1. The existing common shares held by Wendy will be converted into 15,000 Class C preferredshares with a total value and redemption amount of $150,000.

2. ABC will sell to Wendy the house she currently lives in for the sum of $150,000, forconsideration in the form of a non-interest-bearing promissory note.

3. On the anniversary date of the conveyance, and each year thereafter for a total period of fiveyears, ABC will redeem 3,000 Class C preferred shares held by Wendy for the sum $30,000. The amount of such redemption is to be applied against the balance of the

promissory note.

4. In addition to this redemption, Wendy's shares (20,000 Class A preferred shares and 37,000Class B preferred shares) will be redeemed evenly over the next five years for considerationof $114,000 per year.Here is ABC Balance Sheet

Wendy Reggie Total # of old common shares exchanged 150 150 300 # of Class A preferred shares received Fair market value of preferred shares 20,000 $200,000 20,000 $200,000 40,000 $400,000 Section 85 Agreed amount $200,000 $200,000 $400,000 Paid-up capital and adjusted cost base of old common shares Capital gain reported $150 $199,850 $150 $199,850 $300 Small business capital gain exemption claim $199,850 $199,850

Step by Step Solution

3.31 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To Wendy and Reggie From Your Name CPA Date Date Subject Tax Consequences and Recommendations Regarding the Proposed Agreement of Purchase and Sale I Introduction We have reviewed the draft agreement ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started