Question

ABC is a private unlisted firm operating in real estate market. It has entered around a year back in the industry. XYZ has entered

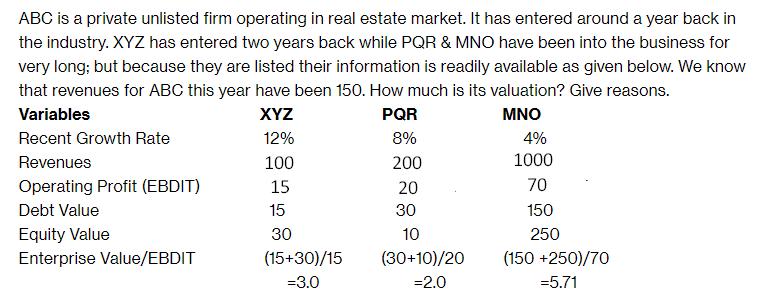

ABC is a private unlisted firm operating in real estate market. It has entered around a year back in the industry. XYZ has entered two years back while PQR & MNO have been into the business for very long; but because they are listed their information is readily available as given below. We know that revenues for ABC this year have been 150. How much is its valuation? Give reasons. XYZ PQR MNO 12% 8% 100 200 15 Variables Recent Growth Rate Revenues Operating Profit (EBDIT) Debt Value Equity Value Enterprise Value/EBDIT 15 30 (15+30)/15 =3.0 20 30 10 (30+10)/20 =2.0 4% 1000 70 150 250 (150 +250)/70 =5.71

Step by Step Solution

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To determine the valuation of ABC we can use the enterprise value to EBITDA multiple approa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Gail Fayerman

1st Canadian Edition

9781118774113, 1118774116, 111803791X, 978-1118037911

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App