Question

ABC is looking to process a cargo of crude and sell the products. It has processing capacity available at the Lake Charles Refinery (LCR) in

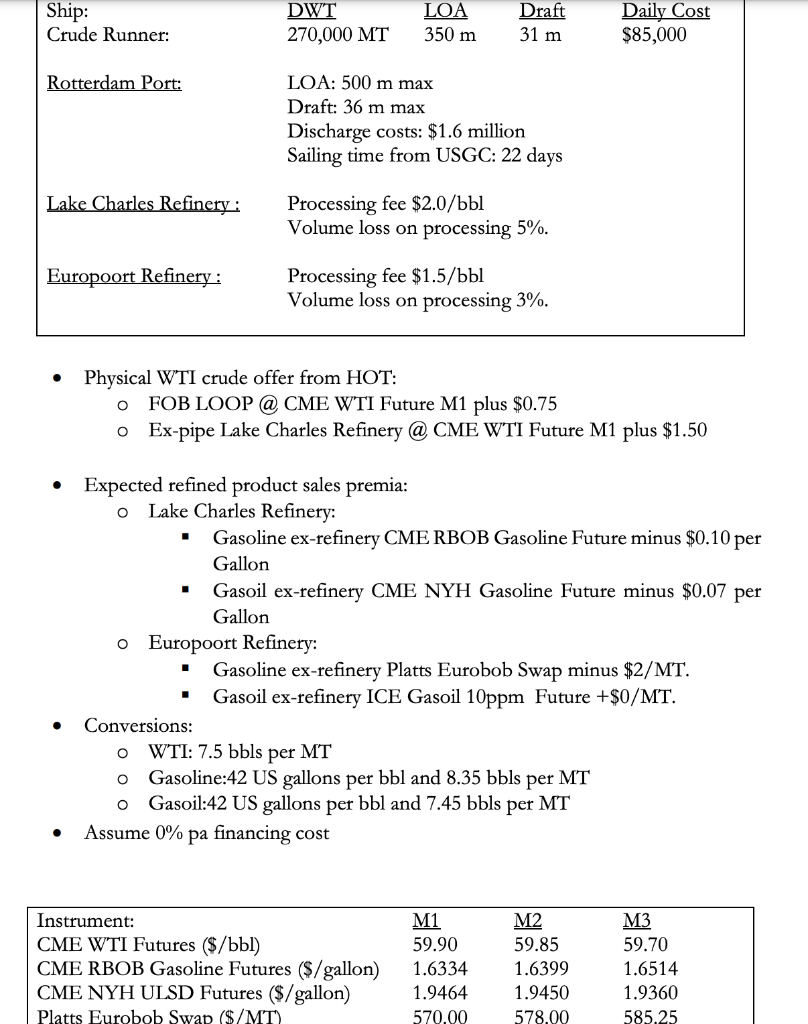

ABC is looking to process a cargo of crude and sell the products. It has processing capacity available at the Lake Charles Refinery (LCR) in Louisiana and at the Europoort Refinery (ER) in Rotterdam. The two refineries are configured differently and when processing a barrel of WTI: LCR yields 2/3 Gasoline and 1/3 Gasoil (3:2:1 crack) ER yields 3/5 Gasoline and 2/5 Gasoil (5:3:2 crack) Houston Oil Trading (HOT) is offering a prompt 2 million bbl parcel of WTI crude oil FOB Louisiana Offshore Oil Port (LOOP). ABC negotiates an option for the parcel to be delivered ex-pipe to the Lake Charles Refinery in Louisiana for a small premium. The Freight Desk has a 270,000dwt ship available, Crude Runner, with NWE option and a full list of major oil company approvals. The sailing time from LOOP to Rotterdam is 22 days. If processing the crude in LCR, there will be a one month delay between purchasing the crude and selling the refined products (buy crude in M1 and sell products in M2) and if processing at ER there will be two months delay (buy crude M1 and sell products M3):

1. Calculate the relevant WTI crack spreads at both LCR and ER. For each refinery, state clearly: a. Which crack spread formula should apply? b. Which month of futures/swaps should apply in each case? c. What is the processing cost in US Dollars? d. What is the freight cost (if applicable) in US Dollars? e. What other costs, in US Dollars, should be taken into account? (as indicated in the question) Should ABC buy and process WTI at LCR or ER? Explain your reasoning.

2. After making your assessment, American Oil Company (AOC) offers ABC a 2 million bbl parcel of Louisiana Light Sweet Crude Oil (LLS) on the same terms as the WTI order from HOT above. LLS has a better Gasoline yield (at the expense of the Gasoil yield). Processing losses are the same as with WTI. LCR yields 70% Gasoline and 30% Gasoil ER yields 62% Gasoline and 38% Gasoil

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started