Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC is the first project of the CU Company. The economic life of this project is 9 years including two years of establishment the

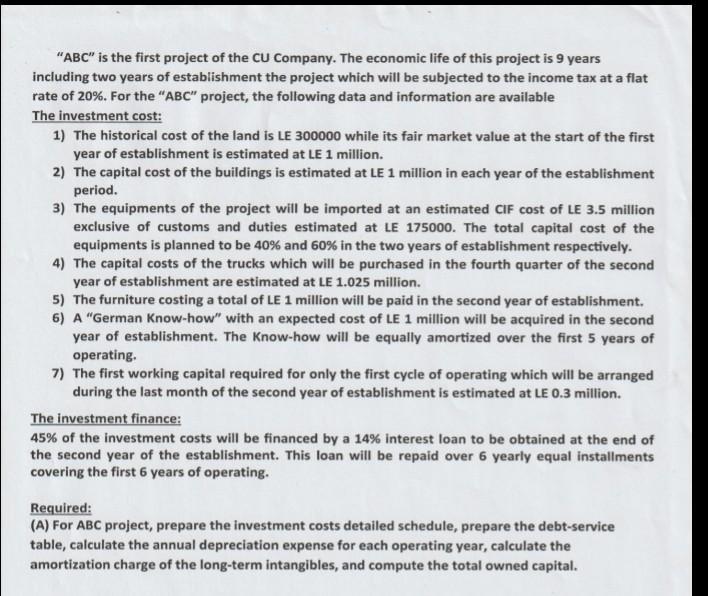

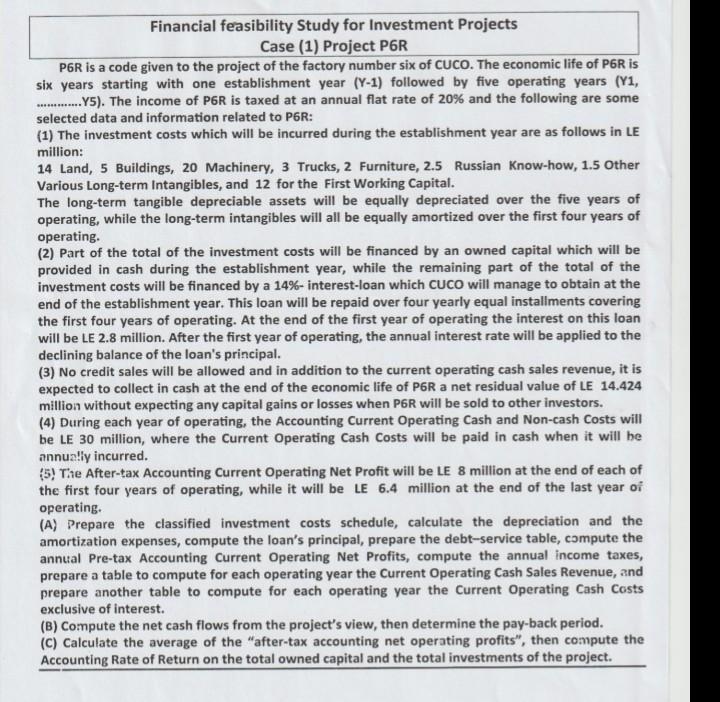

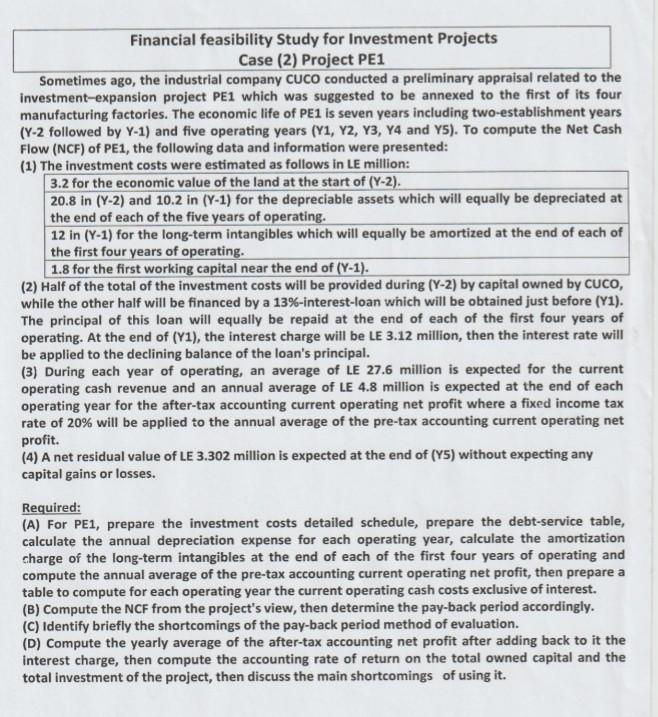

"ABC" is the first project of the CU Company. The economic life of this project is 9 years including two years of establishment the project which will be subjected to the income tax at a flat rate of 20%. For the "ABC" project, the following data and information are available The investment cost: 1) The historical cost of the land is LE 300000 while its fair market value at the start of the first year of establishment is estimated at LE 1 million. 2) The capital cost of the buildings is estimated at LE 1 million in each year of the establishment period. 3) The equipments of the project will be imported at an estimated CIF cost of LE 3.5 million exclusive of customs and duties estimated at LE 175000. The total capital cost of the equipments is planned to be 40% and 60% in the two years of establishment respectively. 4) The capital costs of the trucks which will be purchased in the fourth quarter of the second year of establishment are estimated at LE 1.025 million. 5) The furniture costing a total of LE 1 million will be paid in the second year of establishment. 6) A "German Know-how" with an expected cost of LE 1 million will be acquired in the second year of establishment. The Know-how will be equally amortized over the first 5 years of operating. 7) The first working capital required for only the first cycle of operating which will be arranged during the last month of the second year of establishment is estimated at LE 0.3 million. The investment finance: 45% of the investment costs will be financed by a 14 % interest loan to be obtained at the end of the second year of the establishment. This loan will be repaid over 6 yearly equal installments covering the first 6 years of operating. Required: (A) For ABC project, prepare the investment costs detailed schedule, prepare the debt-service table, calculate the annual depreciation expense for each operating year, calculate the amortization charge of the long-term intangibles, and compute the total owned capital. Financial feasibility Study for Investment Projects Case (1) Project P6R P6R is a code given to the project of the factory number six of CUCO. The economic life of P6R is six years starting with one establishment year (Y-1) followed by five operating years (Y1, ......Y5). The income of P6R is taxed at an annual flat rate of 20% and the following are some selected data and information related to P6R: ... (1) The investment costs which will be incurred during the establishment year are as follows in LE million: 14 Land, 5 Buildings, 20 Machinery, 3 Trucks, 2 Furniture, 2.5 Russian Know-how, 1.5 Other Various Long-term Intangibles, and 12 for the First Working Capital. The long-term tangible depreciable assets will be equally depreciated over the five years of operating, while the long-term intangibles will all be equally amortized over the first four years of operating. (2) Part of the total of the investment costs will be financed by an owned capital which will be provided in cash during the establishment year, while the remaining part of the total of the investment costs will be financed by a 14% - interest-loan which CUCO will manage to obtain at the end of the establishment year. This loan will be repaid over four yearly equal installments covering the first four years of operating. At the end of the first year of operating the interest on this loan will be LE 2.8 million. After the first year of operating, the annual interest rate will be applied to the declining balance of the loan's principal. (3) No credit sales will be allowed and in addition to the current operating cash sales revenue, it is expected to collect in cash at the end of the economic life of P6R a net residual value of LE 14.424 million without expecting any capital gains or losses when P6R will be sold to other investors. (4) During each year of operating, the Accounting Current Operating Cash and Non-cash Costs will be LE 30 million, where the Current Operating Cash Costs will be paid in cash when it will be annually incurred. (5) The After-tax Accounting Current Operating Net Profit will be LE 8 million at the end of each of the first four years of operating, while it will be LE 6.4 million at the end of the last year of operating. (A) Prepare the classified investment costs schedule, calculate the depreciation and the amortization expenses, compute the loan's principal, prepare the debt-service table, compute the annual Pre-tax Accounting Current Operating Net Profits, compute the annual income taxes, prepare a table to compute for each operating year the Current Operating Cash Sales Revenue, and prepare another table to compute for each operating year the Current Operating Cash Costs exclusive of interest. (B) Compute the net cash flows from the project's view, then determine the pay-back period. (C) Calculate the average of the "after-tax accounting net operating profits", then compute the Accounting Rate of Return on the total owned capital and the total investments of the project. Financial feasibility Study for Investment Projects Case (2) Project PE1 Sometimes ago, the industrial company CUCO conducted a preliminary appraisal related to the investment-expansion project PE1 which was suggested to be annexed to the first of its four manufacturing factories. The economic life of PE1 is seven years including two-establishment years (Y-2 followed by Y-1) and five operating years (Y1, Y2, Y3, Y4 and Y5). To compute the Net Cash Flow (NCF) of PE1, the following data and information were presented: (1) The investment costs were estimated as follows in LE million: 3.2 for the economic value of the land at the start of (Y-2). 20.8 in (Y-2) and 10.2 in (Y-1) for the depreciable assets which will equally be depreciated at the end of each of the five years of operating. 12 in (Y-1) for the long-term intangibles which will equally be amortized at the end of each of the first four years of operating. 1.8 for the first working capital near the end of (Y-1). (2) Half of the total of the investment costs will be provided during (Y-2) by capital owned by CUCO, while the other half will be financed by a 13%-interest-loan which will be obtained just before (Y1). The principal of this loan will equally be repaid at the end of each of the first four years of operating. At the end of (Y1), the interest charge will be LE 3.12 million, then the interest rate will be applied to the declining balance of the loan's principal. (3) During each year of operating, an average of LE 27.6 million is expected for the current operating cash revenue and an annual average of LE 4.8 million is expected at the end of each operating year for the after-tax accounting current operating net profit where a fixed income tax rate of 20% will be applied to the annual average of the pre-tax accounting current operating net profit. (4) A net residual value of LE 3.302 million is expected at the end of (Y5) without expecting any capital gains or losses. Required: (A) For PE1, prepare the investment costs detailed schedule, prepare the debt-service table, calculate the annual depreciation expense for each operating year, calculate the amortization charge of the long-term intangibles at the end of each of the first four years of operating and compute the annual average of the pre-tax accounting current operating net profit, then prepare a table to compute for each operating year the current operating cash costs exclusive of interest. (B) Compute the NCF from the project's view, then determine the pay-back period accordingly. (C) Identify briefly the shortcomings of the pay-back period method of evaluation. (D) Compute the yearly average of the after-tax accounting net profit after adding back to it the interest charge, then compute the accounting rate of return on the total owned capital and the total investment of the project, then discuss the main shortcomings of using it.

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Here are the answers to the questions Case 1 A Investment Costs Schedule LE million Land 14 Buildings 5 Machinery 20 Trucks 3 Furniture 2 Knowhow 25 O...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started