Answered step by step

Verified Expert Solution

Question

1 Approved Answer

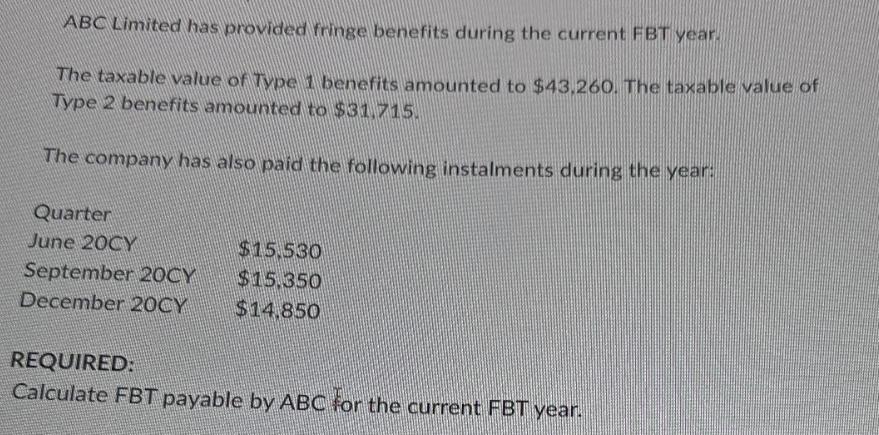

ABC Limited has provided fringe benefits during the current FBT year. The taxable value of Type 1 benefits amounted to $43,260. The taxable value

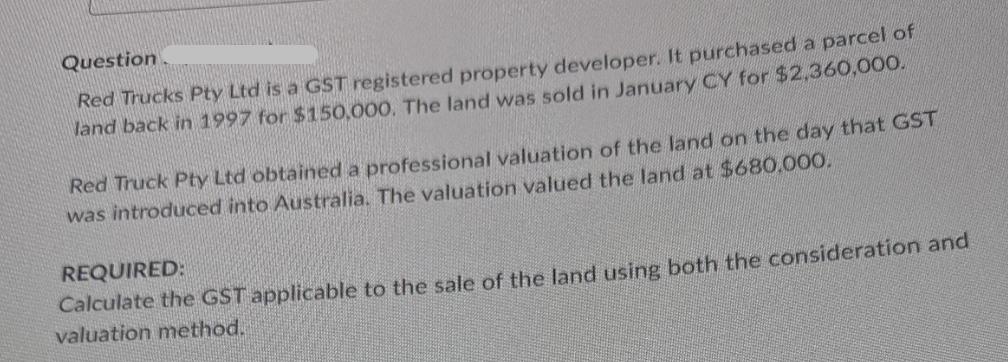

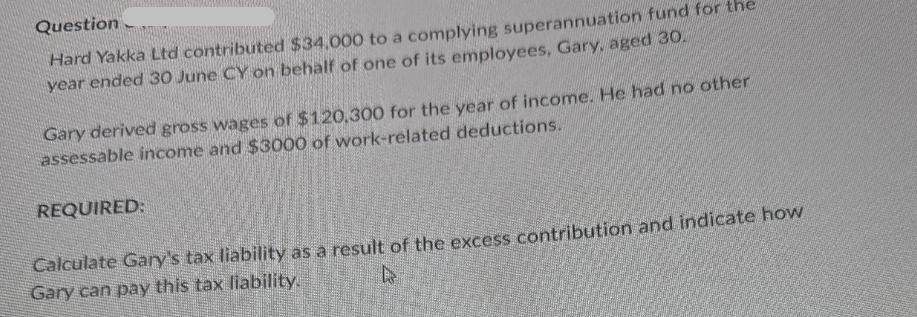

ABC Limited has provided fringe benefits during the current FBT year. The taxable value of Type 1 benefits amounted to $43,260. The taxable value of Type 2 benefits amounted to $31.715. The company has also paid the following instalments during the year: Quarter June 20CY $15,530 September 20CY $15.350 December 20CY $14,850 REQUIRED: Calculate FBT payable by ABC for the current FBT year. Question Red Trucks Pty Ltd is a GST registered property developer. It purchased a parcel of land back in 1997 for $150,000. The land was sold in January CY for $2,360,000. Red Truck Pty Ltd obtained a professional valuation of the land on the day that GST was introduced into Australia. The valuation valued the land at $680.000. REQUIRED: Calculate the GST applicable to the sale of the land using both the consideration and valuation method. Question. Hard Yakka Ltd contributed $34,000 to a complying superannuation fund for the year ended 30 June CY on behalf of one of its employees, Gary, aged 30. Gary derived gross wages of $120,300 for the year of income. He had no other assessable income and $3000 of work-related deductions. REQUIRED: Calculate Gary's tax liability as a result of the excess contribution and indicate how D Gary can pay this tax liability.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the Fringe Benefits Tax FBT payable by ABC Limited for the current FBT year we need to follow these steps Step 1 Calculate the Total Fringe Benefits Amount Total Fringe Benefits Amount ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started