Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC limited recently developed a new product at a cost of 2,500,000 which it intends to introduce to the market soon. There is need

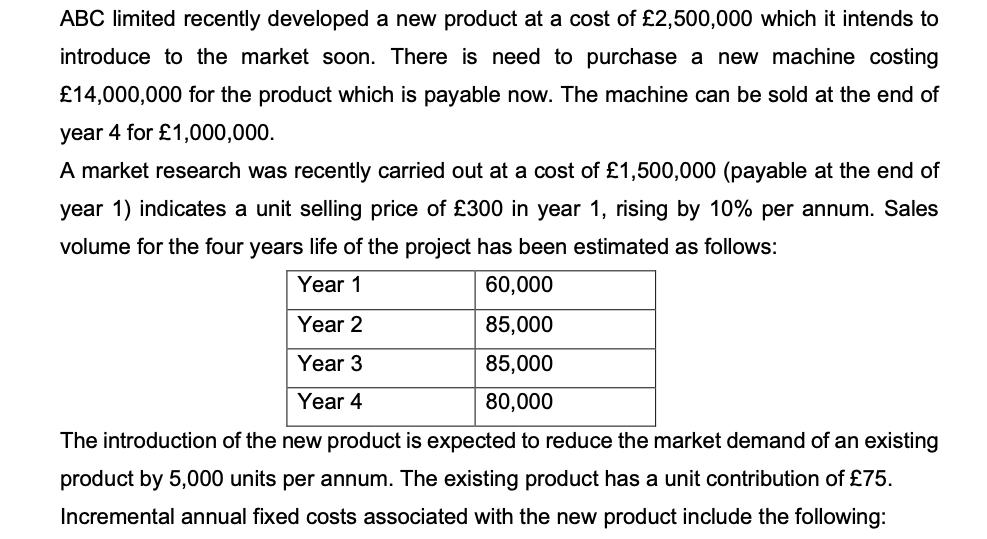

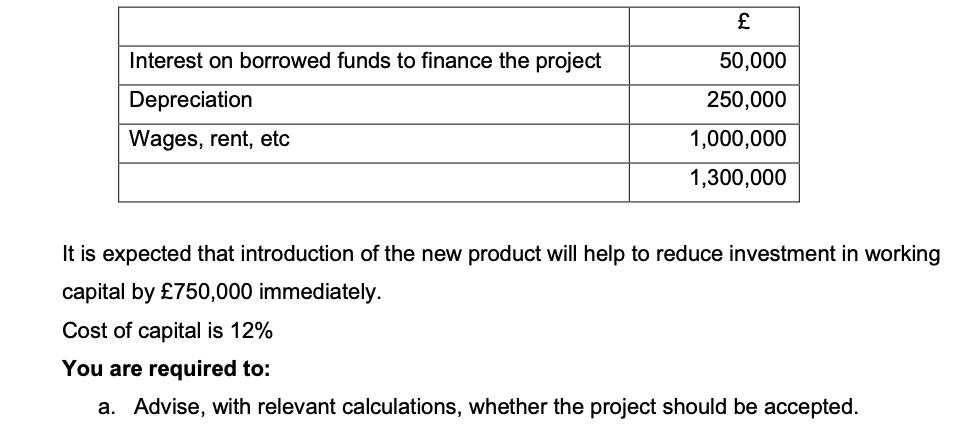

ABC limited recently developed a new product at a cost of 2,500,000 which it intends to introduce to the market soon. There is need to purchase a new machine costing 14,000,000 for the product which is payable now. The machine can be sold at the end of year 4 for 1,000,000. A market research was recently carried out at a cost of 1,500,000 (payable at the end of year 1) indicates a unit selling price of 300 in year 1, rising by 10% per annum. Sales volume for the four years life of the project has been estimated as follows: Year 1 60,000 Year 2 85,000 Year 3 85,000 Year 4 80,000 The introduction of the new product is expected to reduce the market demand of an existing product by 5,000 units per annum. The existing product has a unit contribution of 75. Incremental annual fixed costs associated with the new product include the following: Interest on borrowed funds to finance the project Depreciation Wages, rent, etc 50,000 250,000 1,000,000 1,300,000 It is expected that introduction of the new product will help to reduce investment in working capital by 750,000 immediately. Cost of capital is 12% You are required to: a. Advise, with relevant calculations, whether the project should be accepted. b. Evaluate the importance of NPV in project appraisal (5 marks) c. State and explain briefly THREE factors influencing pricing decisions.

Step by Step Solution

★★★★★

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

a Project Appraisal Calculation of Net Cash Flows 1 Initial Investment Cost of new product development 2500000 Cost of new machine 14000000 Market res...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started