Answered step by step

Verified Expert Solution

Question

1 Approved Answer

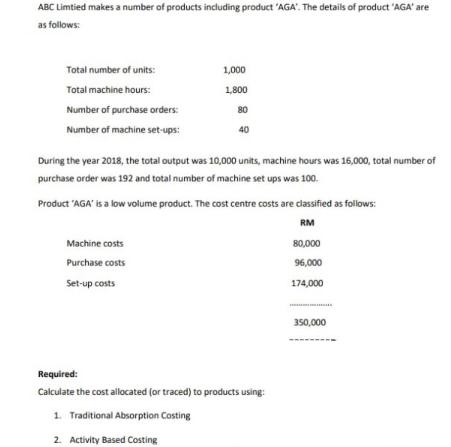

ABC Limtied makes a number of products including product 'AGA. The details of product 'AGA' are as follows: Total number of units: Total machine

ABC Limtied makes a number of products including product 'AGA". The details of product 'AGA' are as follows: Total number of units: Total machine hours: Number of purchase orders: Number of machine set-ups: 1,000 1,800 80 40 During the year 2018, the total output was 10,000 units, machine hours was 16,000, total number of purchase order was 192 and total number of machine set ups was 100. Product 'AGA' is a low volume product. The cost centre costs are classified as follows: RM Machine costs Purchase costs Set-up costs Required: Calculate the cost allocated (or traced) to products using: 1. Traditional Absorption Costing 2. Activity Based Costing 80,000 96,000 174,000 350,000

Step by Step Solution

★★★★★

3.39 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

Traditional Absorption Costing Traditional absorption costing allocates costs to products based on a single cost driver typically direct labor hours m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started