Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Ltd has an inventory turnover ratio of 115 days; the average receivables collection period is 55 days; the average payables turnover period is

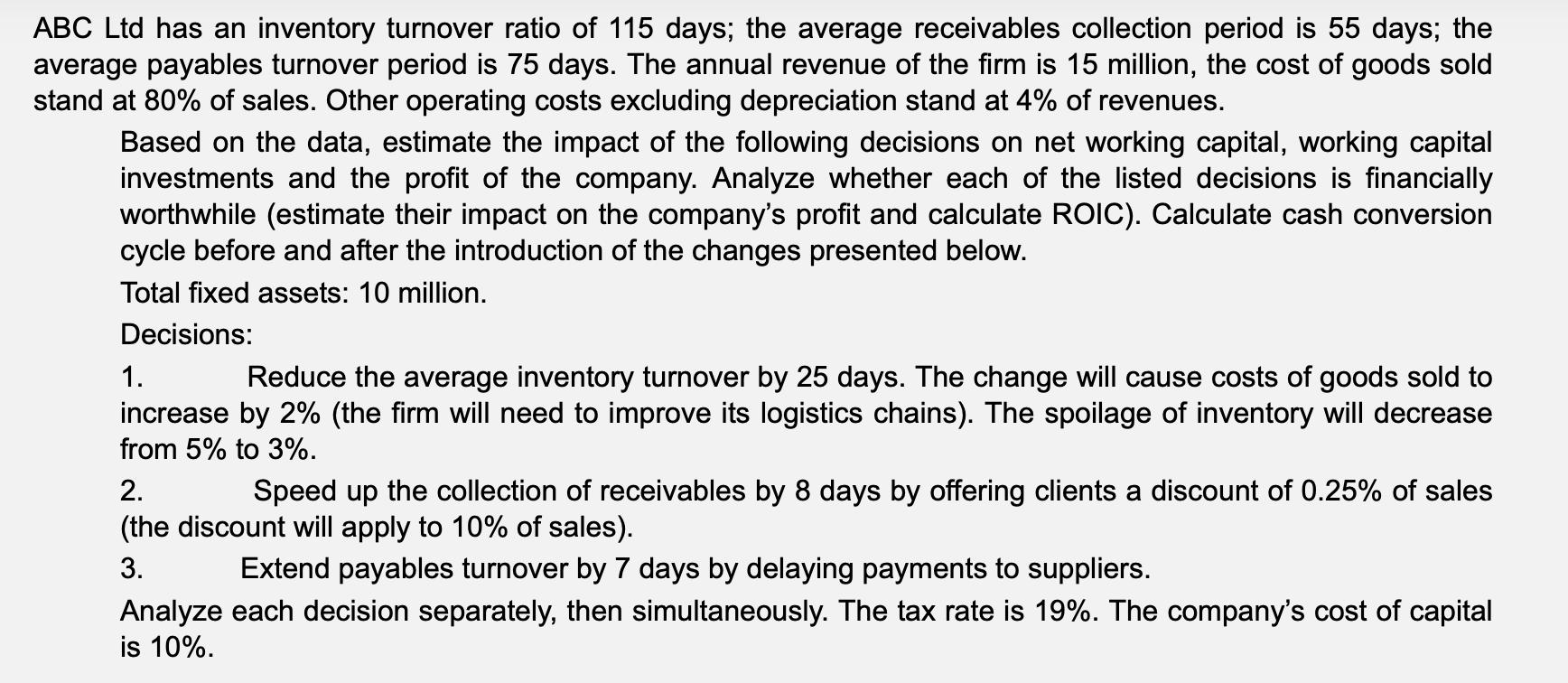

ABC Ltd has an inventory turnover ratio of 115 days; the average receivables collection period is 55 days; the average payables turnover period is 75 days. The annual revenue of the firm is 15 million, the cost of goods sold stand at 80% of sales. Other operating costs excluding depreciation stand at 4% of revenues. Based on the data, estimate the impact of the following decisions on net working capital, working capital investments and the profit of the company. Analyze whether each of the listed decisions is financially worthwhile (estimate their impact on the company's profit and calculate ROIC). Calculate cash conversion cycle before and after the introduction of the changes presented below. Total fixed assets: 10 million. Decisions: 1. Reduce the average inventory turnover by 25 days. The change will cause costs of goods sold to increase by 2% (the firm will need to improve its logistics chains). The spoilage of inventory will decrease from 5% to 3%. 2. Speed up the collection of receivables by 8 days by offering clients a discount of 0.25% of sales (the discount will apply to 10% of sales). 3. Extend payables turnover by 7 days by delaying payments to suppliers. Analyze each decision separately, then simultaneously. The tax rate is 19%. The company's cost of capital is 10%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To analyze the impact of each decision and calculate the cash conversion cycle CCC before and after the changes lets break down each decision and calculate the relevant metrics Decision 1 Reduce avera...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started