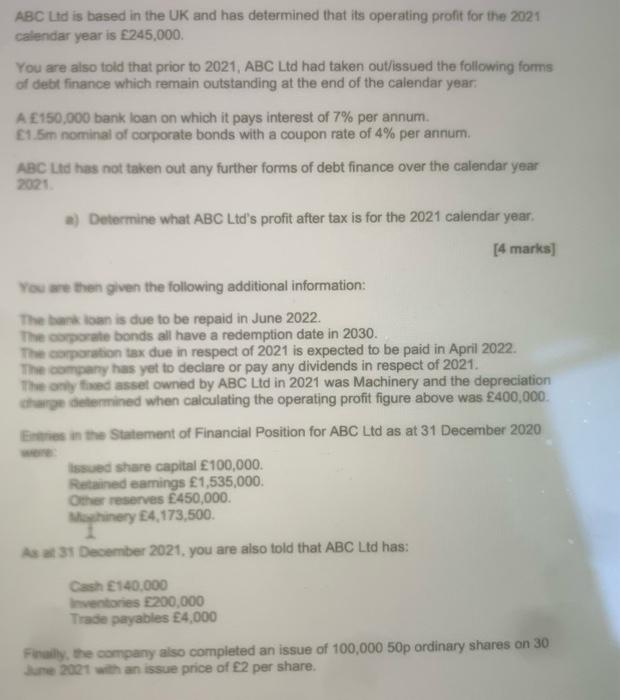

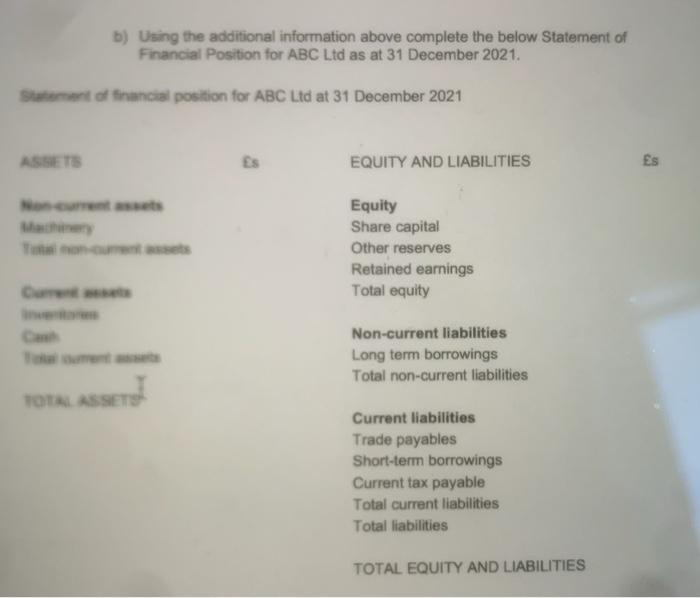

ABC Ltd is based in the UK and has determined that its operating proft for the 2021 calendar year is 245,000. You are also told that prior to 2021, ABC Ltd had taken out/issued the following forms of debt finance which remain outstanding at the end of the calendar year: A 150,000 bank loan on which it pays interest of 7% per annum. E1. 5m nominal of corpocate bonds with a coupon rate of 4% per annum. ABC Lid has not taken out any further forms of debt finance over the calendar year: a) Determine what ABC Ltd's profit after tax is for the 2021 calendar year. [4 marks] You are then given the following additional information: The hard ioan is due to be repaid in June 2022. The camprate bonds all have a redemption date in 2030. The carparation tax due in respect of 2021 is expected to be paid in April 2022. The company has yet to declare or pay any dividends in respect of 2021. The only fimed asset owned by ABC Ltd in 2021 was Machinery and the depreciation ctharge idetemined when calculating the operating profit figure above was {400,000. Entires in the Statement of Financial Position for ABC Litd as at 31 December 2020 were: ibsued share capital 100,000. Retained eamings 1,535,000. Other reserves E450,000. Miswhinery E4,173,500. As at 31 Desember 2021, you are also told that ABC Ltd has: Cash E140,000 Hrentories 200,000 Trade payables 4,000 Fuaily, the company aiso completed an issue of 100,00050p ordinary shares on 30 Jure 2001 with an issue price of 2 per share. b) Using the additional information above complete the below Statement of Financial Position for ABC Ltd as at 31 December 2021. Gtatement of financial position for ABC Ltd at 31 December 2021 ABC Ltd is based in the UK and has determined that its operating proft for the 2021 calendar year is 245,000. You are also told that prior to 2021, ABC Ltd had taken out/issued the following forms of debt finance which remain outstanding at the end of the calendar year: A 150,000 bank loan on which it pays interest of 7% per annum. E1. 5m nominal of corpocate bonds with a coupon rate of 4% per annum. ABC Lid has not taken out any further forms of debt finance over the calendar year: a) Determine what ABC Ltd's profit after tax is for the 2021 calendar year. [4 marks] You are then given the following additional information: The hard ioan is due to be repaid in June 2022. The camprate bonds all have a redemption date in 2030. The carparation tax due in respect of 2021 is expected to be paid in April 2022. The company has yet to declare or pay any dividends in respect of 2021. The only fimed asset owned by ABC Ltd in 2021 was Machinery and the depreciation ctharge idetemined when calculating the operating profit figure above was {400,000. Entires in the Statement of Financial Position for ABC Litd as at 31 December 2020 were: ibsued share capital 100,000. Retained eamings 1,535,000. Other reserves E450,000. Miswhinery E4,173,500. As at 31 Desember 2021, you are also told that ABC Ltd has: Cash E140,000 Hrentories 200,000 Trade payables 4,000 Fuaily, the company aiso completed an issue of 100,00050p ordinary shares on 30 Jure 2001 with an issue price of 2 per share. b) Using the additional information above complete the below Statement of Financial Position for ABC Ltd as at 31 December 2021. Gtatement of financial position for ABC Ltd at 31 December 2021