Question

ABC Ltd is considering a new machine which will reduce net cash flow by $40000 in the current year, but increase net cash inflow

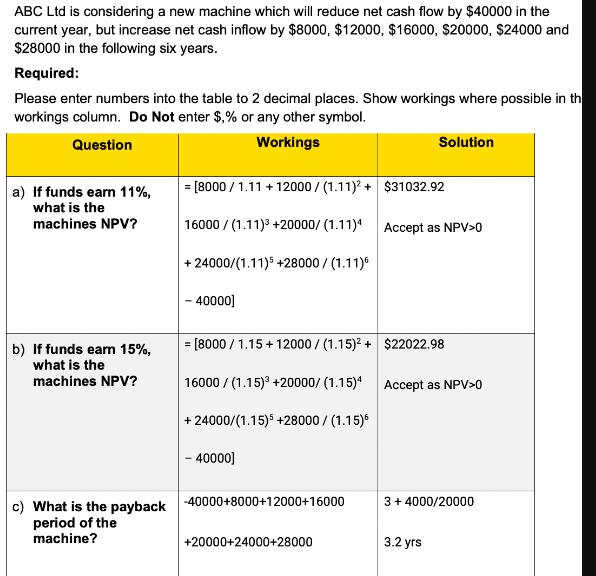

ABC Ltd is considering a new machine which will reduce net cash flow by $40000 in the current year, but increase net cash inflow by $8000, $12000, $16000, $20000, $24000 and $28000 in the following six years. Required: Please enter numbers into the table to 2 decimal places. Show workings where possible in th workings column. Do Not enter $,% or any other symbol. Question Workings Solution a) If funds earn 11%, what is the [8000/1.11 +12000/(1.11)2+ $31032.92 16000/(1.11)3+20000/ (1.11)4 Accept as NPV>0 machines NPV? b) If funds earn 15%, what is the machines NPV? + 24000/(1.11)5 +28000 / (1.11)6 - 40000] [8000/1.15 +12000/(1.15)2+ $22022.98 16000/(1.15) +20000/ (1.15)4 Accept as NPV>0 +24000/(1.15)5 +28000/(1.15)6 - 40000] c) What is the payback period of the machine? -40000+8000+12000+16000 3+ 4000/20000 +20000+24000+28000 3.2 yrs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Business Reporting For Decision Making

Authors: Jacqueline Birt, Keryn Chalmers, Suzanne Maloney, Albie Brooks, Judy Oliver, David Bond

7th Edition

0730369323, 9780730369325

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App