Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Ltd is considering an investment in a new machine for the production of a new product X. There are two possibilities, Machine A

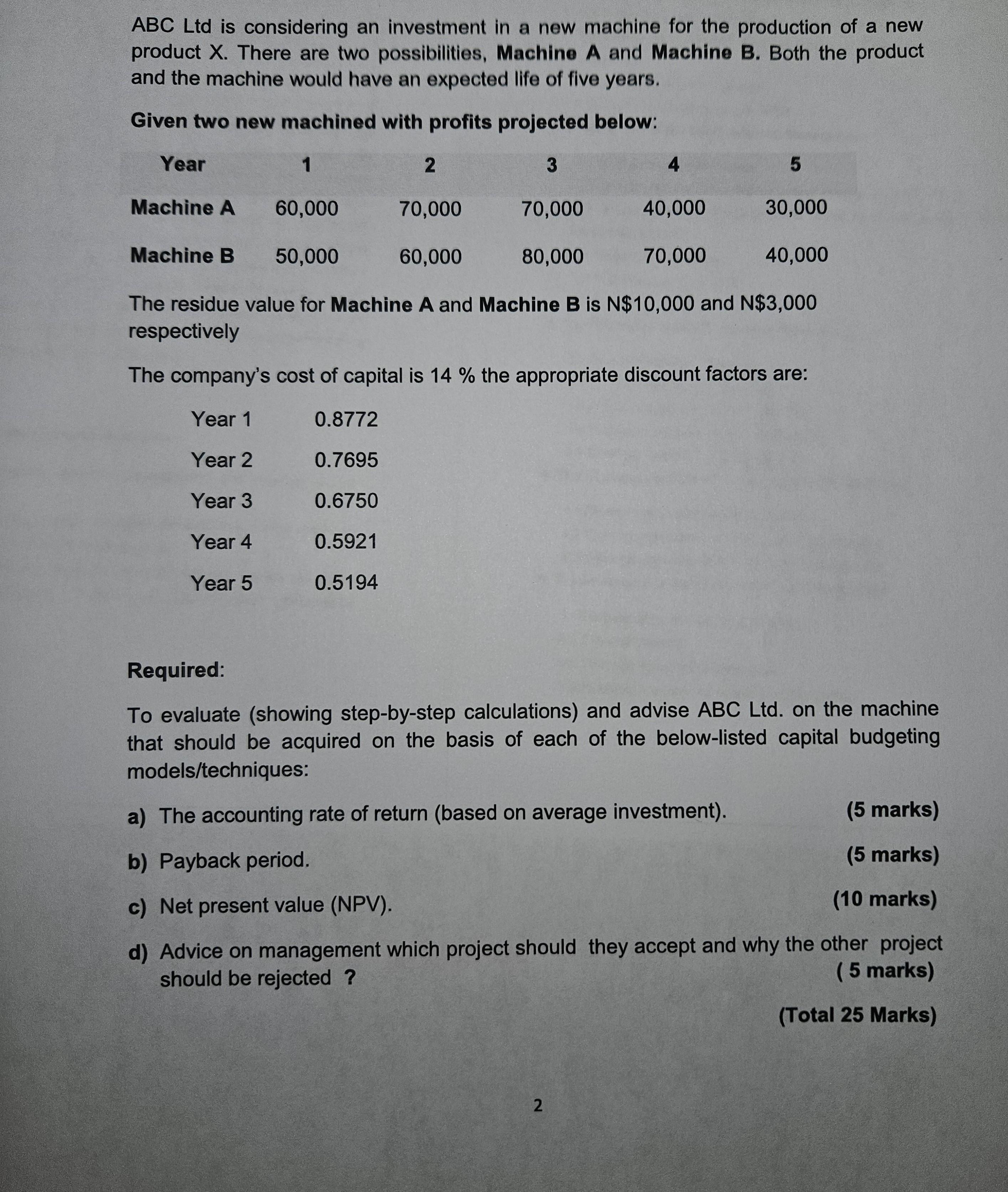

ABC Ltd is considering an investment in a new machine for the production of a new product X. There are two possibilities, Machine A and Machine B. Both the product and the machine would have an expected life of five years. Given two new machined with profits projected below: Year 1 2 3 4 5 Machine A 60,000 70,000 70,000 40,000 30,000 Machine B 50,000 60,000 80,000 70,000 40,000 The residue value for Machine A and Machine B is N$10,000 and N$3,000 respectively The company's cost of capital is 14 % the appropriate discount factors are: Year 1 0.8772 Year 2 0.7695 Year 3 0.6750 Year 4 0.5921 Year 5 0.5194 Required: To evaluate (showing step-by-step calculations) and advise ABC Ltd. on the machine that should be acquired on the basis of each of the below-listed capital budgeting models/techniques: a) The accounting rate of return (based on average investment). b) Payback period. c) Net present value (NPV). (5 marks) (5 marks) (10 marks) d) Advice on management which project should they accept and why the other project should be rejected ? 2 (5 marks) (Total 25 Marks)

Step by Step Solution

★★★★★

3.30 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Accounting Rate of Return ARR The accounting rate of return is calculated as the average annual profit divided by the average investment For Machine ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d954e826fb_964859.pdf

180 KBs PDF File

663d954e826fb_964859.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started