Question

ABC Ltd shares are assumed to be trading at their fair value of $63.09. The dividend per share next year is $2.35 and grows

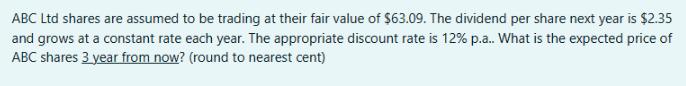

ABC Ltd shares are assumed to be trading at their fair value of $63.09. The dividend per share next year is $2.35 and grows at a constant rate each year. The appropriate discount rate is 12% p.a.. What is the expected price of ABC shares 3 year from now? (round to nearest cent)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

we are using the Gordon Growth Model also known DDM which is PD 1rg Where ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Jonathan Berk, Peter DeMarzo

6th Global Edition

1292446315, 978-1292446318

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App