Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Mining has discovered a new gold deposit in the California mountains and must now decide whether to mine the deposit. The most cost-effective way

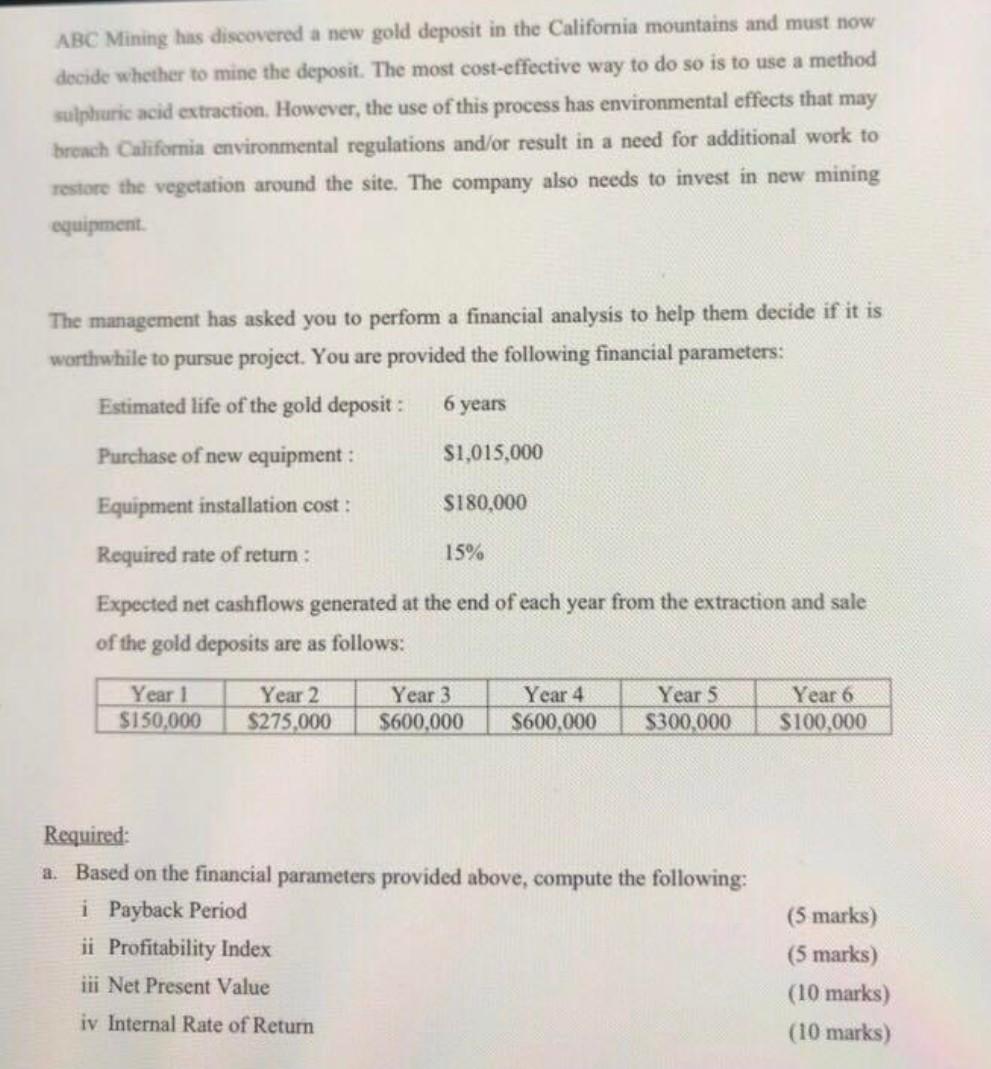

ABC Mining has discovered a new gold deposit in the California mountains and must now decide whether to mine the deposit. The most cost-effective way to do so is to use a method sulphuric acid extraction. However, the use of this process has environmental effects that may breach California environmental regulations and/or result in a need for additional work to restore the vegetation around the site. The company also needs to invest in new mining equipment. The management has asked you to perform a financial analysis to help them decide if it is worthwhile to pursue project. You are provided the following financial parameters: Estimated life of the gold deposit : 6 years Purchase of new equipment: $1,015,000 Equipment installation cost : Required rate of return: Expected net cashflows generated at the end of each year from the extraction and sale of the gold deposits are as follows: Year 1 $150,000 a. Year 2 $275,000 $180,000 15% Year 3 Year 4 Year 5 $600,000 $600,000 $300,000 Required: Based the financial parameters provided above, compute the following: i Payback Period ii Profitability Index iii Net Present Value iv Internal Rate of Return Year 6 $100,000 (5 marks) (5 marks) (10 marks) (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started