Question

ABC plc has issued 10,000,000 ordinary shares of a nominal value of $1 each. Details of the company's earnings and dividends per share during the

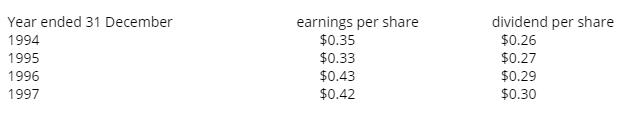

ABC plc has issued 10,000,000 ordinary shares of a nominal value of $1 each. Details of the company's earnings and dividends per share during the last four years are as follows:

The current, December 1997 market value of each ordinary share of ABC plc is $2.35 cum div.

1. The 1997 dividend of $0.30 per share is due to be paid in January 1998. Estimate the cost of capital for ABC plc's ordinary share capital

2. 10 years ago, ABC plc issue 2.5 million dollars 6% redeemable debentures at a price of $98 per cent. The debentures are redeemable six years from now at a price of 102 dollars percent. They are currently quoted at 59 dollars percent, ex interest. Estimate the cost of capital for ABC plc's redeemable debentures.

3.For a bond, face value of 1000 dollars, four years life, coupon at 8%, YTM off 10%. Estimate both the price and duration

Year ended 31 December 1994 1995 1996 1997 earnings per share $0.35 $0.33 $0.43 $0.42 dividend per share $0.26 $0.27 $0.29 $0.30

Step by Step Solution

3.35 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1 Ke Dividend market value per share 30235 1277approx 3 1 Kd 1835 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started