Question

ABC Pte Ltd designs and makes tailor made engagement rings, wedding bands and sentimental jewellery. The company uses a job costing system and manufacturing overhead

ABC Pte Ltd designs and makes tailor made engagement rings, wedding bands and sentimental jewellery. The company uses a job costing system and manufacturing overhead is applied on the basis of direct labour hours.

In the budget for the current year, the following budgeted costs were included:

Manufacturing overhead.........................................$210,000

Direct labour cost.....................................................$120,000

Budgeted direct labour rate.....................................$15 per hour

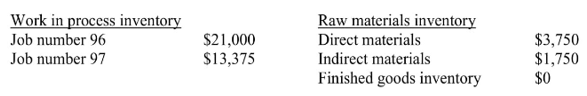

On 1 April, the company had the following balances:

During the month, the following occurred:

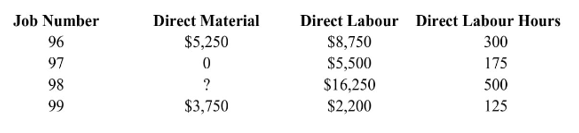

(i) The company worked on four jobs. The costs incurred and direct labour hours consumed were as shown below:

(ii) Overhead for the month were as follow:

Indirect materials (all were used in production)......................................................... ?

Depreciation - plant & machineries............................................................................ $8,500

Depreciation - delivery vans........................................................................................ $1,250

Salaries - production..................................................................................................... $15,000

Salaries - sales & administration................................................................................. $12,500

Other factory costs......................................................................................................... $34,875

Other selling and administration costs........................................................................ $20,000

(iii) Raw Materials purchased on credit:

Direct Material........................................................................ $18,750

Indirect Material..................................................................... $13,750

(iv) Spoilage & reworked costs

Job 96 Normal spoilage amounting to $1,000 and abnormal spoilage of $250 were incurred.

Job 97 Normal spoilage with estimated disposal selling price of $400 was incurred.

Job 98 Rework cost of $250 was incurred.

(v) The company completed job number 96 and job number 97. Job number 97 was sold for cash at the selling price that will enable the company to earn a gross profit margin of 50%

(vi) On 30 April, the company had the following balances:

Work in process:......................................................?

Job Number........................................................98 $8,500

Job Number........................................................99 $1,250

.............................................................................. $15,000

Raw Materials Inventory:

Direct materials.................................................$2,500

Indirect materials...............................................$3,000

Finished Goods inventory.....................................?

Required:

(a) Determine the company's predetermined overhead rate.

(b) Compute and show the following:

(i) The cost of direct material issued to the job number 98.

(ii) The cost of indirect material to be included in the manufacturing overhead.

(c) Provide the journal entries to describe the following:

(i) Issue of direct material to production and the direct labour incurred.

(ii) Manufacturing overhead incurred during the month.

(iii) Application of overhead to production.

(iv) The costs of spoilage, rework and scrap.

(v) Completion of job number 96 and job number 97.

(vi) The sale of job number 97.

(d) Using job order costing, determine the cost of the jobs that were still in production as at 30 April.

(e) Calculate the cost of the finished goods inventory as at 30 April.

Work in process inventory Job number 96 Job number 97 $21,000 $13,375 Raw materials inventory Direct materials Indirect materials Finished goods inventory $3,750 $1,750 $0 Job Number 96 97 98 99 Direct Material $5,250 0 ? $3,750 Direct Labour Direct Labour Hours 300 175 $8,750 $5,500 $16,250 $2,200 500 125

Step by Step Solution

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Companys predetermined overhead rate Estimated overhead Estimated Direct Labor Hours Total Labour ho...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started